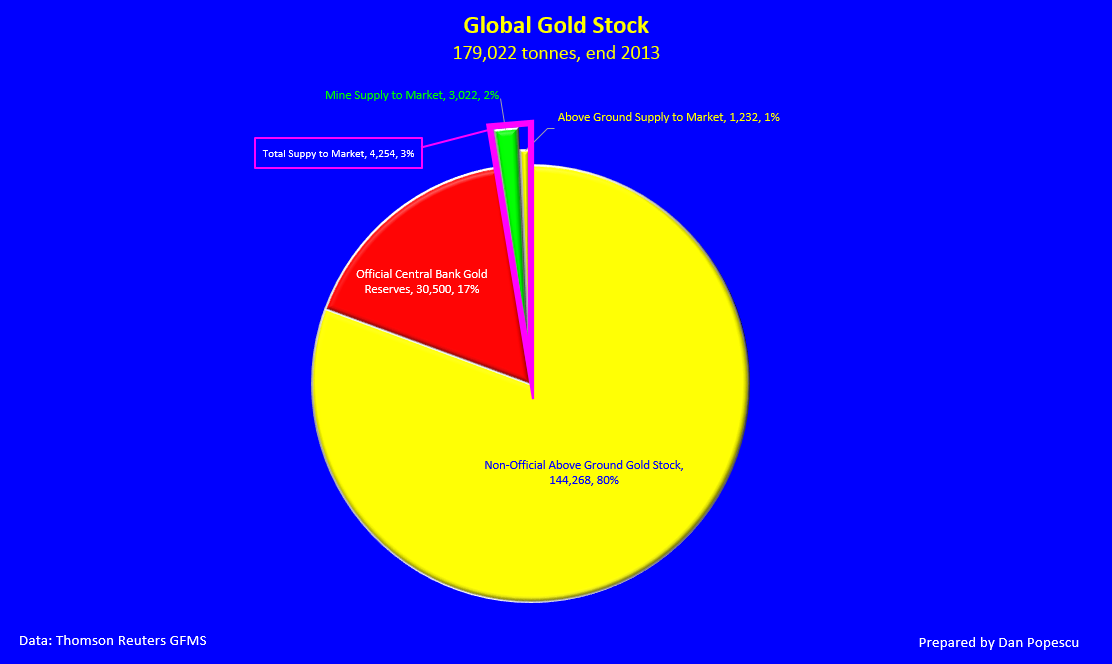

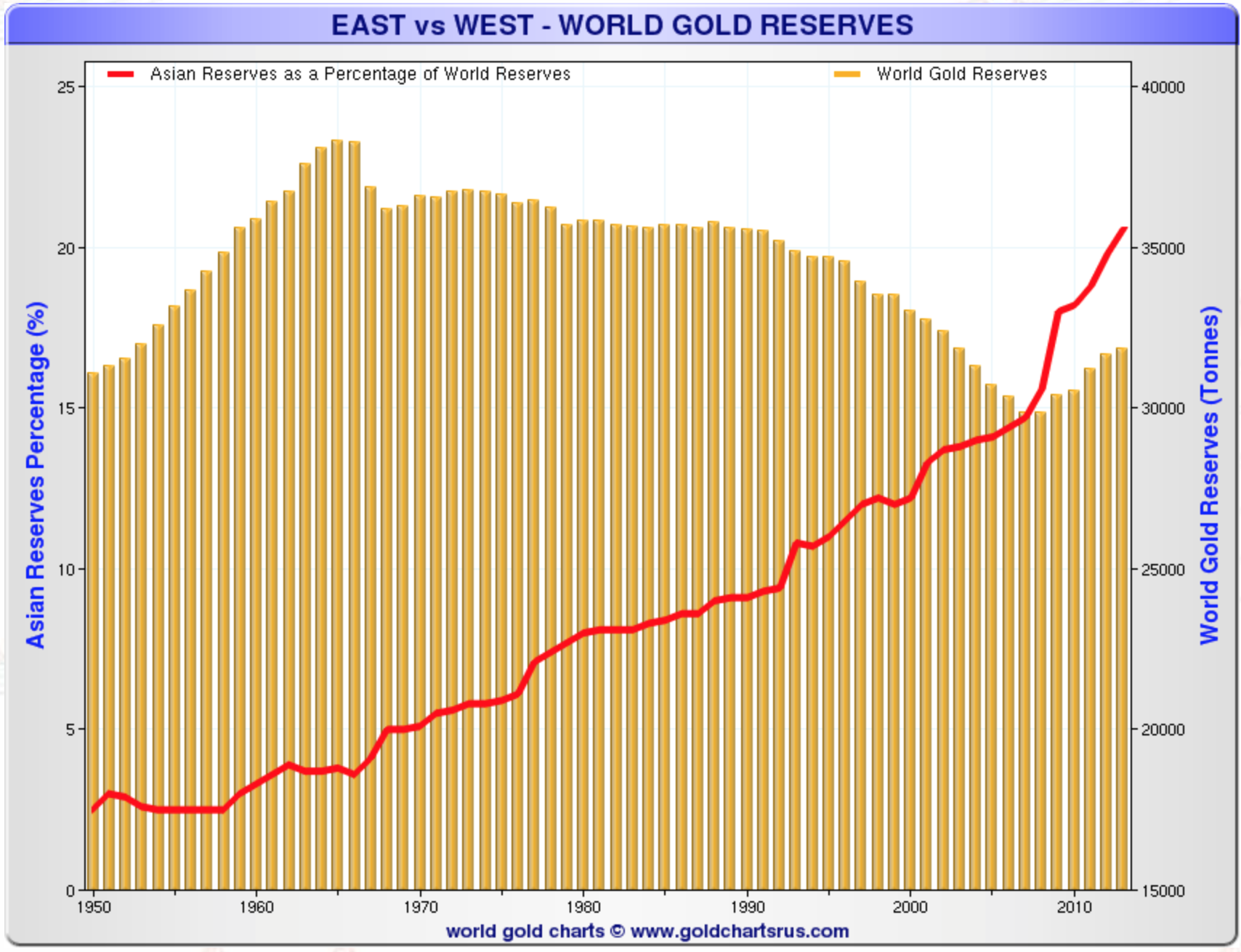

If gold is a relic of the past then why are central banks holding so much gold? Central banks hold, if we believe official statistics, around 20% of the global gold stock. Before the gold suppressing efforts began, they were holding 70%. Since the financial crisis of 2008, they have started to buy gold again. However, if we look at a chart of gold acquisitions by developing countries, they have started buying gold just after the Asian currency crisis in 1987. It seems that all the gold sold by developed countries was bought discretely by developing countries.

Bron Suchecki writes in a recent blog, “I think it is interesting that mainstream investors, adults who put their faith/trust in governments and central bankers to manage the economy, and not in gold, don't see the contradiction in the fact that those very governments and central bankers hold gold themselves. If gold is such a stupid investment, doesn't that make governments and central bankers stupid? In which case you shouldn't trust them. In which case you need some gold. Alan Greenspan said, “If, in the words of the British economist John Maynard Keynes, gold were a ‘barbarous relic,’ central banks around the world would not have so much of an asset which rate of return, including storage costs, is negative.”

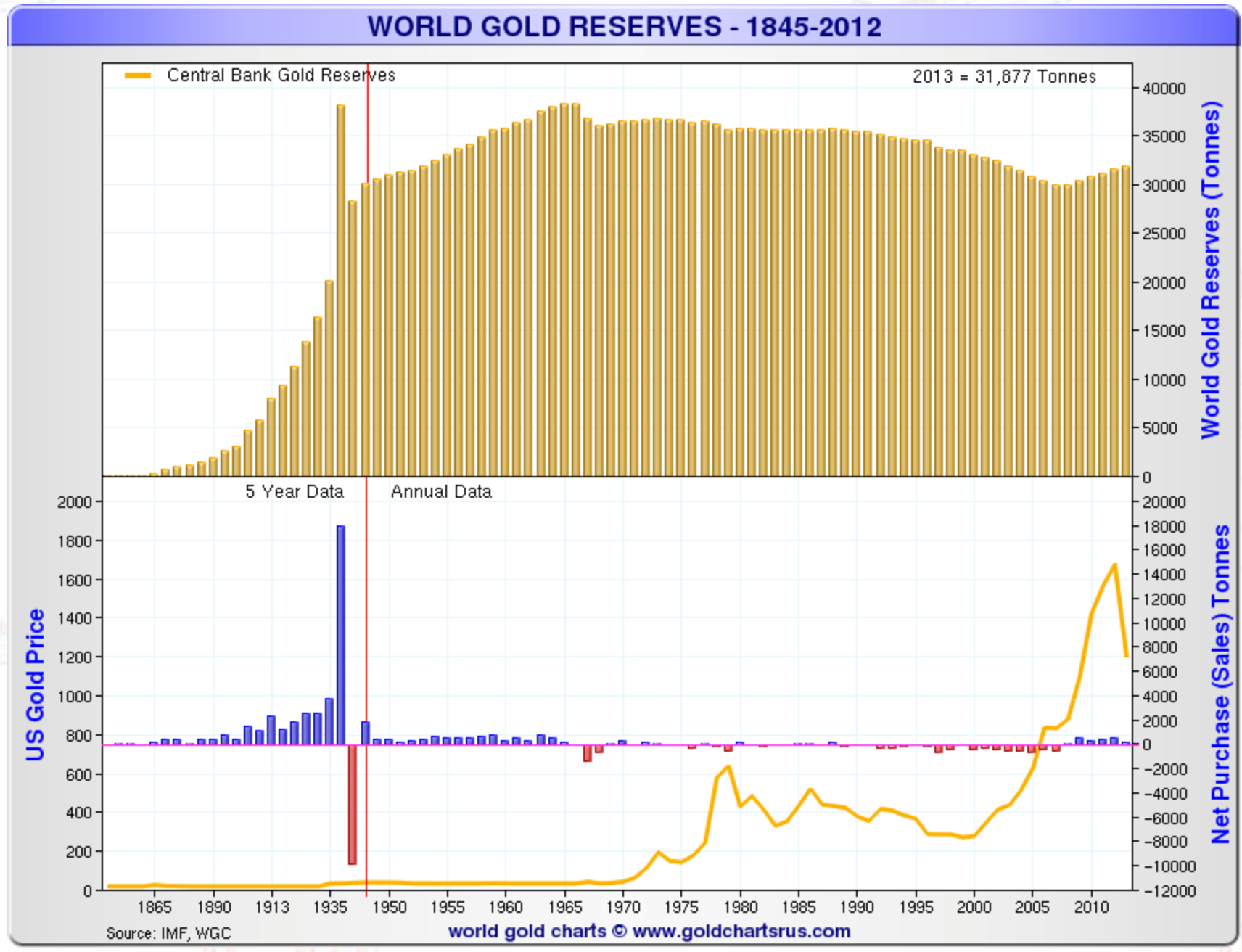

Should the U.S. sell all of its gold? Why hasn’t it been done yet? For years the Fed, Treasury and economic academia in the U.S. have been bad-mouthing gold but none have proposed any concrete action to go all the way and replace this “useless metal”, this “relic of the past”, with fiat currency or other hard assets. Is it “Do as I say, not as I do”? If we look at the next two charts, we can clearly see that official gold reserves barely dropped from about 37,000 tonnes to around 30,000 tonnes. The drop stopped just before the financial crisis of 2008 and, since then, it has increased again.

Also interesting to observe in the next graph is the increase in gold holdings by developing countries like China, Russia and others. Therefore, it seems that most of the gold sold by developed countries’ central banks was bought by developing countries’ central banks. The trend became large enough to counter the sales and reverse the downtrend in world gold reserves in 2007 just before the financial crisis in 2008.

The low in gold price was reached around 2000. Between 1999 and 2002 Gordon Brown, UK’s Chancellor of the Exchequer, sold 60% of the UK's gold reserves shortly before gold entered a protracted bull market, since nicknamed by dealers as the Brown Bottom.

James Turk says, “Gold is the barometer by which central bank management of a country’s currency and economy is being gauged and evaluated. A rising gold price is a sign that monetary danger lies ahead, such as inflation or banking problems. A falling or low-and-steady gold price is taken by the market as a sign that all is well with the national currency and the economy. Clearly, central bankers would rather not have gold looking over their shoulders at every move. So central bankers have been at war with gold.”

Antal Fekete also says that, “governments have correctly identified gold as the only antidote against their effort to build the Tower of Babel of irredeemable debt”, and “Official hatred of gold bordering on the neurotic appears less irrational if we contemplate that gold, and gold alone, is capable of exposing the ever-present bad faith behind the promises of the powers that be.”

This year, Mario Draghi, ECB president, surprised many, including myself, when he stated without hesitation, “For central banks this [gold] is a reserve of safety, it’s viewed by the country as such. In the case of non-dollar countries it gives you a value protection against fluctuations of the dollar.” It was a very direct, unambiguous and strong pro-gold statement and it came from a central banker. He was responding to a question without hesitation that contrasted with U.S. Federal Reserve chairman’s Ben Bernanke’s uneasiness when answering similar questions on gold.

Zhang Jianhua, of the People’s Bank of China, said in an interview, “No asset is safe now. The only choice to hedge risks is to hold hard currency – gold.” Sun Zhaoxue also said in an article that “Currently, there are more and more people recognizing that the ‘gold is useless‘ story contains too many lies. Gold now suffers from a ‘smokescreen’ designed by the U.S., which stores 74% of global official gold reserves, to put down other currencies and maintain the US dollar hegemony.”

Russian bullion expert Dmitriy Balkovskiy says, “Elvira Nabiullina, Putin’s recent appointee at the Bank of Russia, is familiar with Ludwig von Mises and is well known in Moscow’s libertarian circles.” (von Mises and libertarian circles are pro-gold in general). Not to speak of Vladimir Putin himself, who didn’t hesitate to be photographed holding a gold bar and supposedly asked the central bank of Russia to bring gold reserves to above 10% of total reserves.

He also recently told foreign journalists at the St. Petersburg Economic Forum 2014, "For us [Russia and China], it is important to deposit those [gold and currency reserves] in a rational and secure way … and we [China and Russia] together need to think of how to do that, keeping in mind the uneasy situation in the global economy."

Contrary to Ben Bernanke, Alan Greenspan, his predecessor at the Fed, never hid his favoritism towards gold. That didn’t stop him to state that, if necessary, the Fed was ready to use derivatives markets to sell gold. Speaking to the U.S. Congress in 1999, he said, "Gold still represents the ultimate form of payment in the world. Fiat money, in extremis, is accepted by nobody. Gold is always accepted."

Eveline Widmer-Schlumpf, Swiss finance minister, just before the Swiss Gold Referendum, warned that the “credibility of monetary policy” would be “greatly impaired” if the floor of 20% gold reserves was introduced. She also described gold as “among the most volatile” and “riskiest investments” on the central bank’s books; that, while Switzerland is still a very large holder of gold in its reserves.

Note also that the International Monetary Fund (IMF) states on its website, “The IMF holds a relatively large amount of gold among its assets, not only for reasons of financial soundness, but also to meet unforeseen contingencies.”

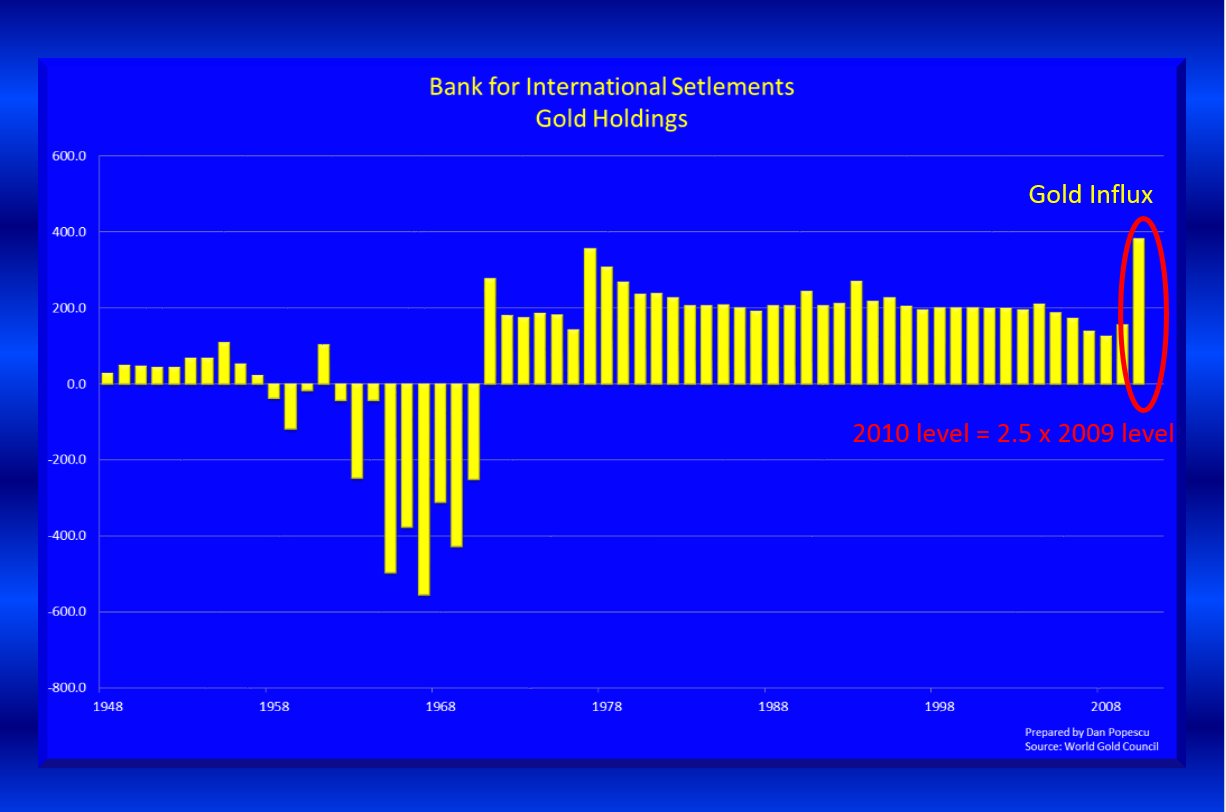

In the graph below, we can see the explosion in gold holdings at the “bank” of central banks, the Bank for International Settlements (BIS). What is significant about this or these BIS transactions is that gold was being used in international settlements after so many decades of being sidelined in the monetary system.The transaction itself confirms that gold is being used in this manner, which is a dynamic confirmation of gold's return to the monetary system. This episode reveals just how fragile the financial system pre-April 2010 actually was and, I think, still is, and demonstrates how governments have mobilized gold to indirectly support commercial banks. Gold’s old emergency usefulness has resurfaced during the 2008 crisis, albeit behind closed doors at BIS in Basel, Switzerland.

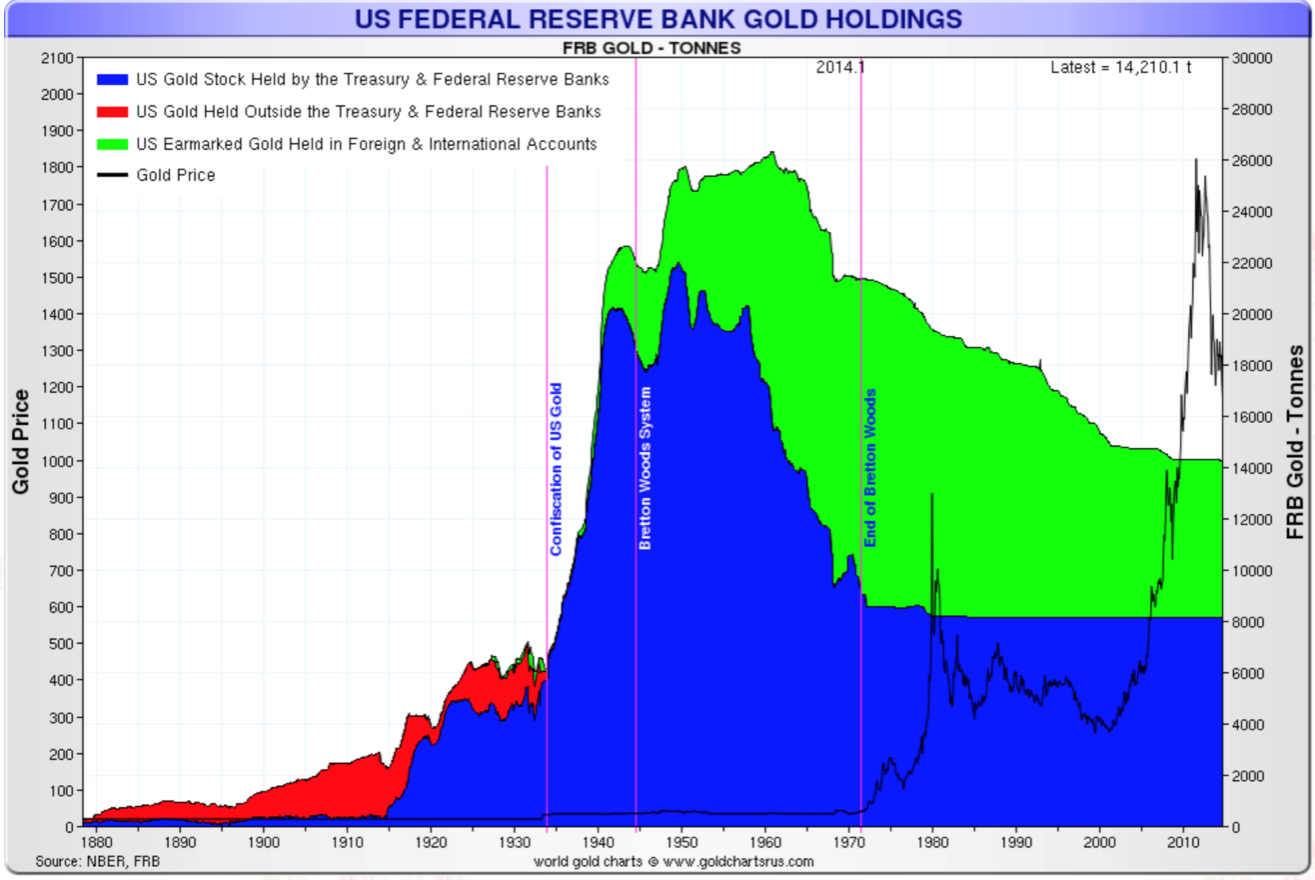

I would like you to look now at the next two charts. They represent the gold deposited by foreign central banks in the U.S. As you can see, the repatriation of gold started in the ‘60s, just before the collapse of the Bretton Woods system in 1971, and continued steadily until 2000.

Since 2000, we have had three episodes of acceleration in repatriations. They correspond with the Sept. 11, 2001 New York attack and the Iraq war that followed, the 2008 financial crisis and now the new Cold War menacing and a global monetary crisis. Since the end of 2013, it has become evident that there is a run on the gold stored in the U.S., sometimes openly and, more often, discreetly.

The power of gold seems to transcend any modern economic theory and something tells us all, no matter how illiterate or educated we are, that gold is not just a relic of the past but the most liquid and marketable asset in extreme times.

The rationale behind the governments and central banks suppressing the price of gold is that gold is a hard currency and a political metal. As long as there has been money, rulers or governments have always intervened and especially when they dilapidated all the country’s wealth and got into an exorbitant level of debt.

Peter Bernstein, in the late ‘90s, when gold was at its lowest, in an excellent book on gold but critical of gold, The Power of Gold, cautioned, “Gold may again serve as the ultimate hedge in chaotic conditions. Its return to its traditional role as universal money is unlikely, however, unless the time should come when the dollar, the euro, and the yen have all failed to function as acceptable means of payment across international borders.” We seem to be getting closer and closer to such chaotic conditions since 2008.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.