On July 29, New York gold price closed at $1,097.20 up $1.60. The dollar was a cent stronger at $1.0963, with the Dollar Index stronger at 97.31 up from 96.64. This morning, July 30, the London LBMA gold price was set at $1,085.65, down $1.10. The euro equivalent was €989.43, down €1.80 on yesterday.

The silver price closed in New York on July 29 at $14.82, up 14 cents. This morning, July 30, the London LBMA silver price was set at $14.64, down 3 cents.

Longer-term gold is still in a consolidation phase but with a downward bias with no clear indication of future direction up or down yet.

1. China Boosts Gold Reserves 57% in First Disclosure Since ’09

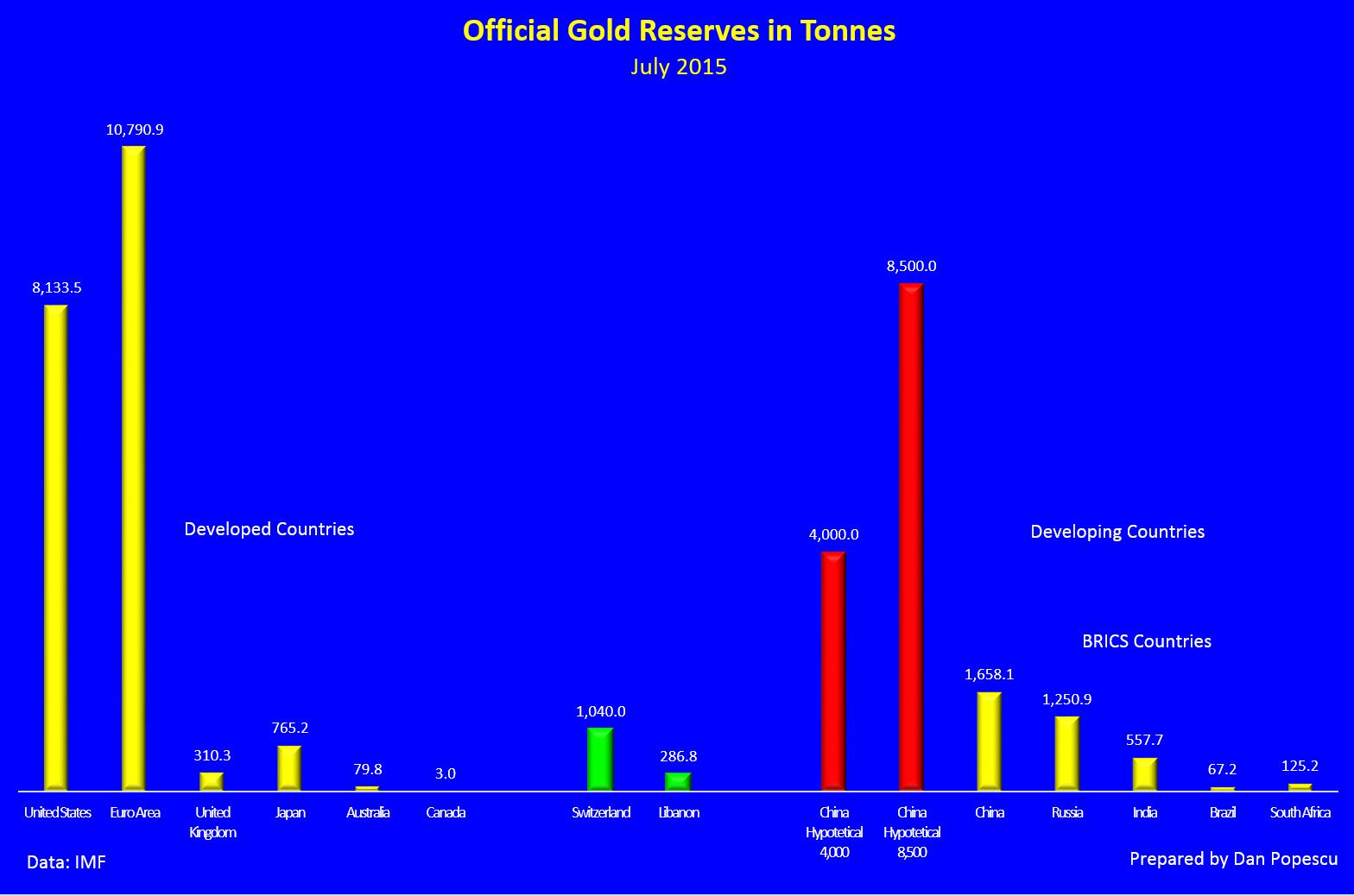

Two weeks ago, China updated its gold reserves. In so doing, China ended six years of mystery over how much gold it is hoarding, revealing a 57 percent jump in reserves and overtaking Russia to become the country with the fifth-largest stash of gold .On a percentage basis of total foreign exchange reserves, it puts China in last place in the BRICS (Brazil, Russia, India, China, and South Africa) countries and far away from the United States and the Euro Zone. With 4,000 tonnes, it would still have been in last place in the BRICS countries. Looking at the gold reserves as a percentage of GDP, the announcement still keeps China with 0.6 percent, in last place within the BRICS countries and far from the US’s 1.8 percent and Euro zone’s 3.2 percent. On the other hand, with 4,000 tonnes it would have brought China close to the BRICS average and close to the US’s 1.8 percent. Many analysts expected a much larger quantity with estimates between 2,500 and 4,000 tonnes. Some analysts believe China has under-reported its gold reserves for strategic reasons.

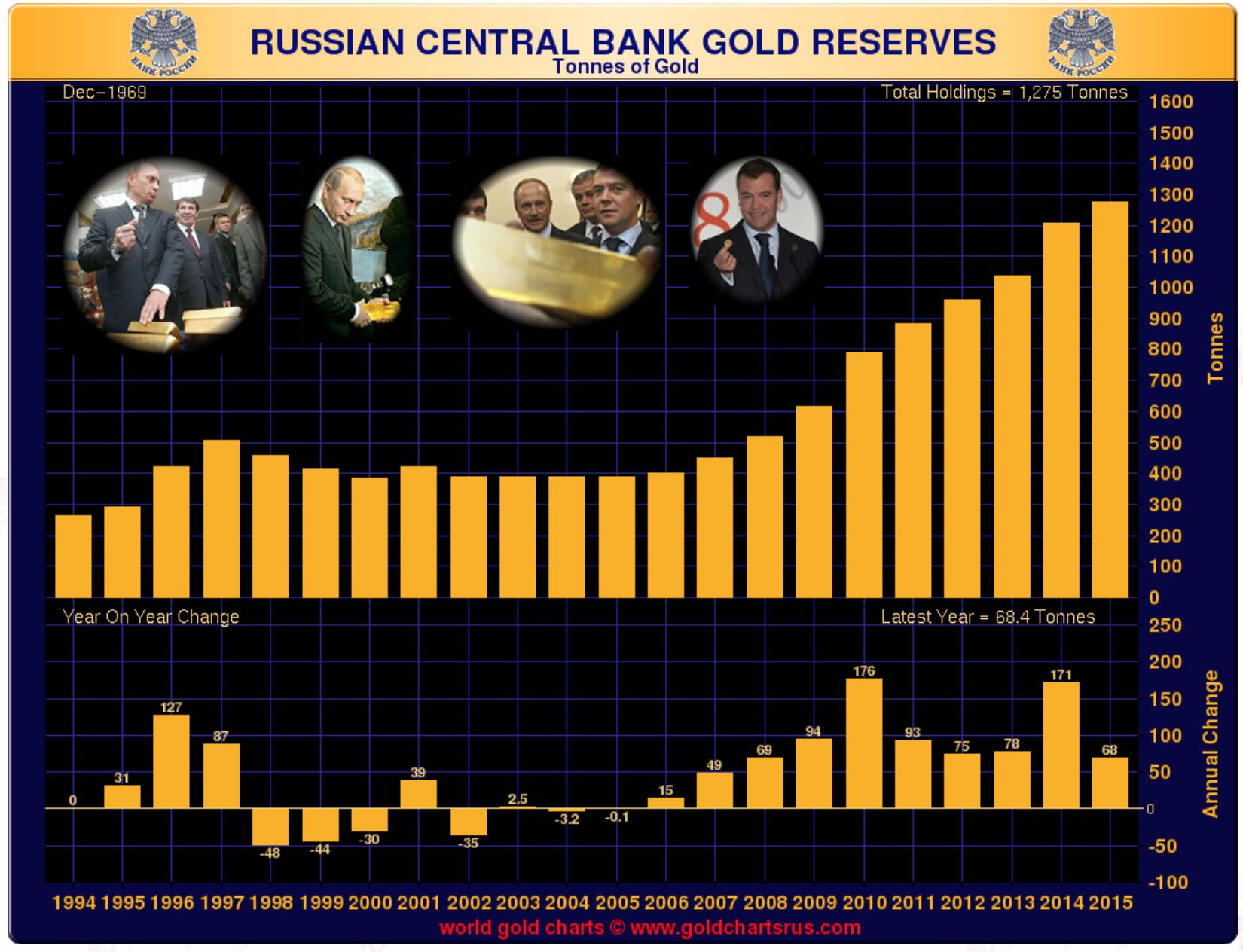

2. Russia’s Gold reserves since 2009 have increased more than China’s

Russia’s Gold reserves since 2009 have increased more than China’s. Russia more than tripled its reserves since 2005 and Kazakhstan raised its reserves every month since October 2012. Russia added 24.9 tonnes of gold to its reserves in June. Since 2009 Russia has added 668 tonnes of gold to its reserves, more than China, which added 604 tons during the same period. Elvira Nabiullina, Chairwoman of the Russian Central Bank, said recently, “Recent experiences forced us to reconsider some of our ideas about sufficient and comfortable levels of gold reserves.” Also in a recent CNBC interview, Ms. Nabiullina remarked on Russia’s increasing gold reserves, saying, “We base ourselves upon the principles of diversification of our international reserves and we bought gold not only last year but during the previous years. Our gold mining industry is very well developed and it is ready to supply gold.

Source: https://smaulgld.com/russian-gold-reserves-grow-by-800000-ounces-in-june/

3. China's gold imports are to plunge as financing deals unwind

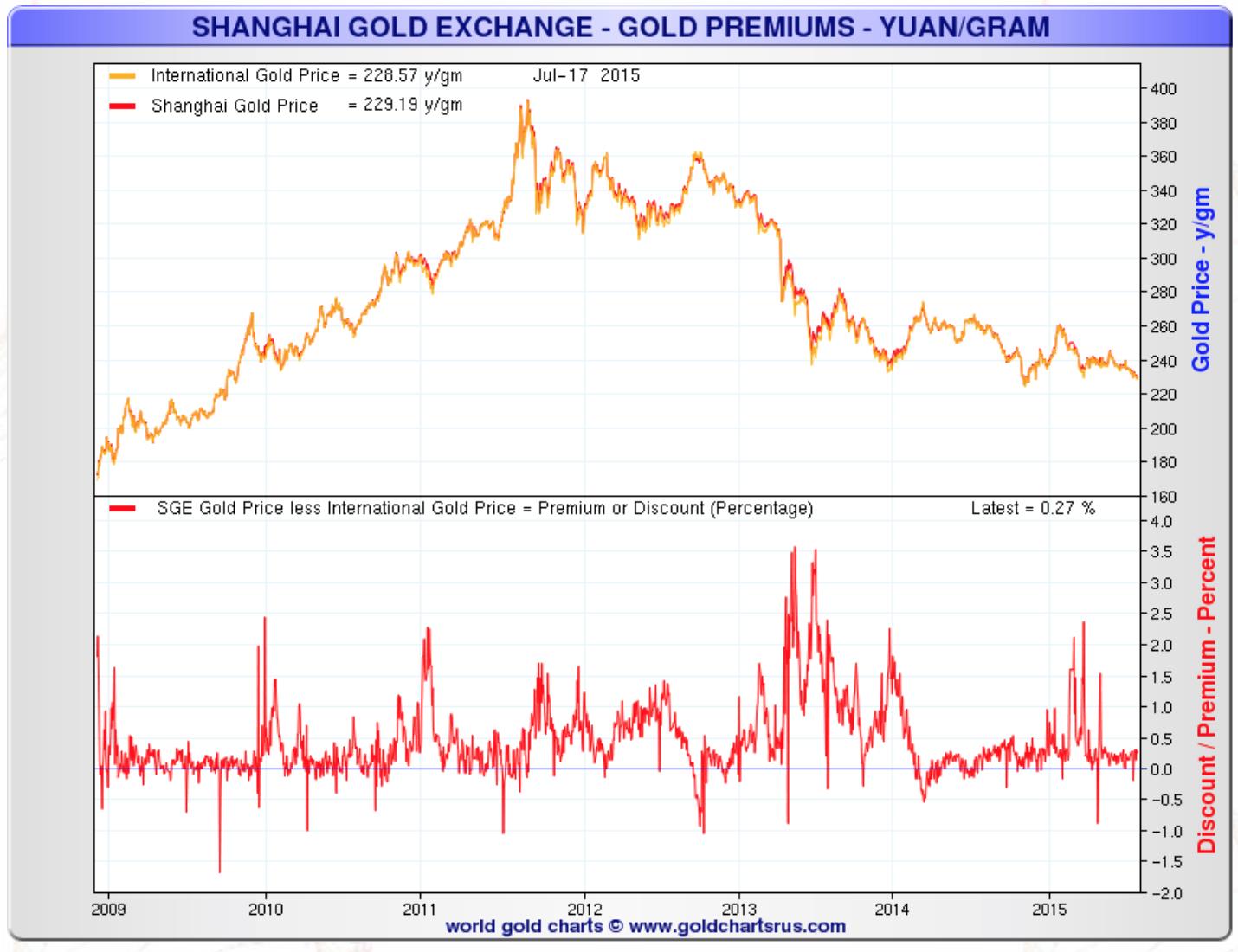

China's gold imports could fall as much as 40 percent this year as demand for bullion used to back domestic financing deals decreases, the world's biggest refiner Valcambi said. A lot of the gold China imported in the last three years was used to secure cheaper loans due to a liquidity crunch, but that is now flowing back into the market as lending rates drop. Valcambi’s Chief Executive Michael Mesaric told Reuters, "All this gold that was used for financing has been given back as there is liquidity in the market and liquidity is cheap." The decline in China's appetite is evident as seen with the modest premiums on the Shanghai Gold Exchange over the global benchmark.

Source: http://www.reuters.com/article/2015/07/28/china-gold-imports-idUSL3N1074L920150728

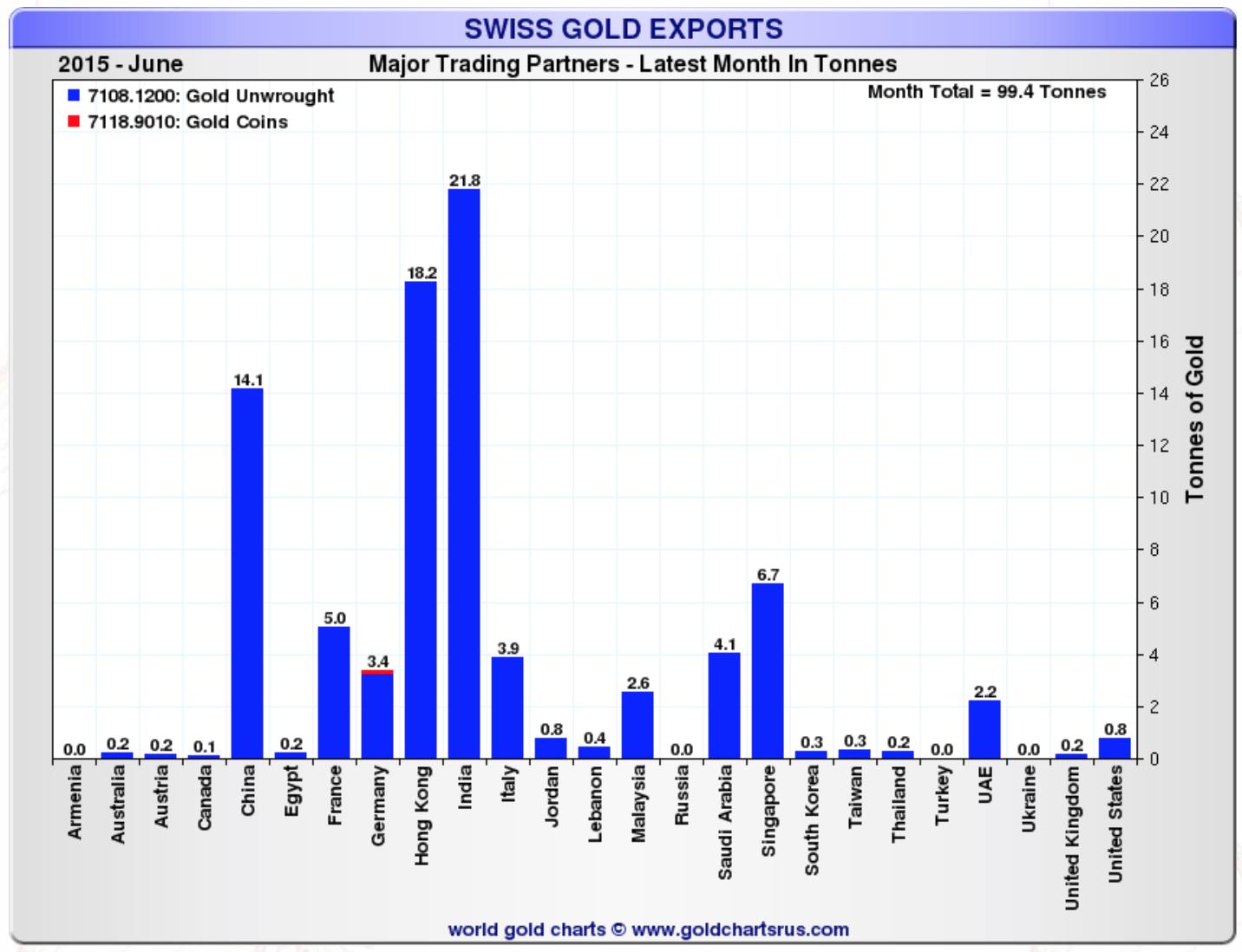

4. 44% of June Swiss gold exports to China bypassed Hong Kong

Lawrence Williams says in a recent article that the importance of Hong Kong as a channel for Chinese gold imports continues to diminish with nearly half of Swiss June gold exports going now directly to mainland China. India, Hong Kong and China between them accounted for 54 percent of total Swiss gold exports, and if one adds in other south Asian and east Asian nations, the area accounted for around 65% of all Swiss gold exports that month. In June total Swiss gold exports totalled just under 100 tonnes with 32.3 tonnes going to China and Hong Kong combined. But of this total fully 43.6 percent went directly to the Chinese mainland, bypassing Hong Kong altogether, which makes the Hong Kong export figures to China less and less indicative of overall Chinese gold imports.

Source: http://lawrieongold.com/2015/07/28/44-of-june-swiss-gold-exports-to-china-bypassed-hong-kong/

5. Gold demand weakest since 2009 in second quarter as Chinese turned to stocks

According to the latest Thomson Reuters GFMS quarterly report demand for gold slid to its lowest in six years in the second quarter of this year as buyers from top consumer China poured funds into its now troubled equities market. However, a subsequent plunge in Chinese share prices from mid-June has not helped bullion, the report said, as some investors were locked in and others nervous about switching to different asset classes while financial markets are so volatile."Gold has certainly moved out of favor in China in recent quarters," saysGFMS analyst Andrew Leyland. He also added,"Chinese purchasers tend to buy into rallies, so when gold gets some upward momentum Chinese purchasing should support this."

Source: http://www.reuters.com/article/2015/07/28/us-gold-demand-gfms-idUSKCN0Q212N20150728

6.Mega-bear Albert Edwards says gold is a 'must-have' even after the latest price slump

In a recent article Albert Edwards, from Societe Generale, said: “I have not one scintilla of doubt that the Western central banks have set us up for an even bigger version of the 2008 Great Financial Crisis/Recession – but this time rock bottom interest rates and large fiscal deficits will mean only one thing: QE will be stepped up to such a pace that you will hear the roar of the printing presses from Mars. Gold is a must-have holding in that world.”

7.Marc Faber

Marc Faber says that “if he could short central banks directly he would do so, but gold is the next best thing.”

> AUDIO MP3: Click here to download

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.