Transcription:

1. China plans to launch yuan gold fix by end of 2015

From a report on Reuters, we learn that China plans to launch a yuan-denominated gold fix by the end of 2015 via the Shanghai Gold Exchange (SGE), in a move aimed at giving the world's biggest bullion producer and consumer more influence over pricing. Given its leading role in gold, China feels, according to Reuters, it is entitled to be a price-setter for bullion and is asserting itself at a time when the global benchmark, the century-old London fix, is under scrutiny for alleged price-manipulation. The yuan fix's success will depend on the participation of foreign banks, which may be reluctant to join given the global scrutiny of benchmarks following the manipulation of the London interbank offered rate. This event coincides with the announcement by the IMF to include or not the yuan in the Special Drawing Rights.

Source: Reuters

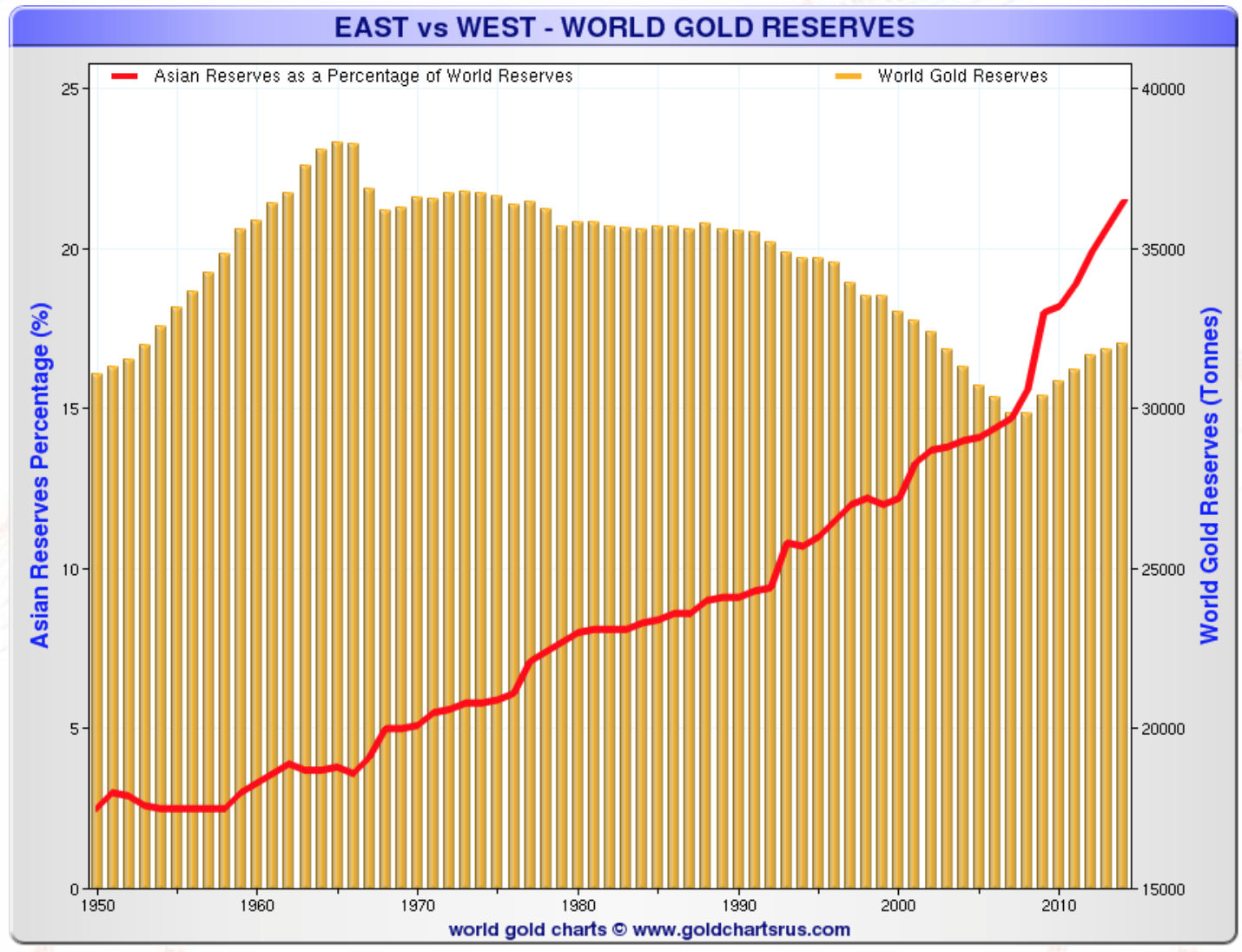

2. Study migration of gold from west to east continues unabated

According to the 2015 Incrementum’s In Gold We Trust Report that was just published, in 1980 Europe and the US were still responsible for 70% of the gold demand; today they account for a mere 20%. China and India remain the most important forces on the demand side. Apart from the “fear trade”, they represent the major drivers of the bull market. A significant increase in investment demand has recently become evident in China. The main reason is likely fear of a creeping devaluation of savings. How much of this demand is individual and how much is official we still don’t know but a possible announcement of China’s official gold reserves could happened in the fall of this year. The last time China made public its gold reserves was in 2009.

LAST MINUTE UPDATE: China just broke silence on gold reserves

Source: In Gold We Trust 2015 Report

3. For the first time since August 2009, gold is 'undervalued'

According to the Economics Times of India for the first time since August 2009, gold is 'undervalued'. In its latest fund manager survey, Bank of America Merrill Lynch notes that on a valuation basis, gold was viewed as "undervalued" by fund managers for the first time since August 2009. Rick Bensignor, chief market strategist at R.F. Lafferty, says that $1,150, with a small margin either way, is a big price level for gold.

Source: The Economic Times

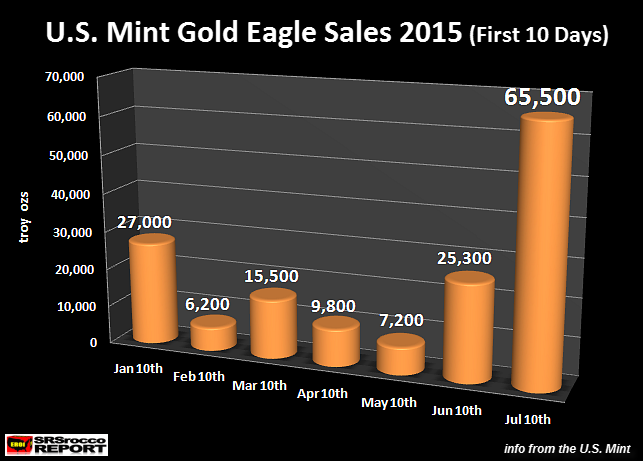

4. Gold Eagle Sales Surge On Financial Turmoil

SRSrocco Report writes that at the beginning of July the U.S. Mint updated its figures showing sales of its Gold Eagles surged to a level not seen for more than a year. Sales of Gold Eagles have been strong ever since the financial turmoil in Europe increased significantly with the threat of a Greek Exit.

Source: SRSrocco Report

5. For Indians, paper gold can't beat the real thing

In a recent article Reuters informs us that India is meeting stiff resistance in its drive to make the buying of gold jewelry more transparent and to channel demand into paper gold to stop the metal being used to hide billions of dollars of undeclared 'black money'. The article also says that gold inflows into India will continue unabated in a country that accounts for nearly a fifth of the global gold demand. Two-thirds of the gold demand comes from rural areas where jewelry is a traditional store of wealth. Under Prime Minister Modi, India has opened 160 million new bank accounts but half are idle, suggesting old habits die hard. Indians still prefer physical gold to paper gold. To try to divert some of the estimated 300 tonnes of annual demand for gold bars and coins to paper gold, the government also plans to issue bonds linked to the bullion price.

Source: Reuters

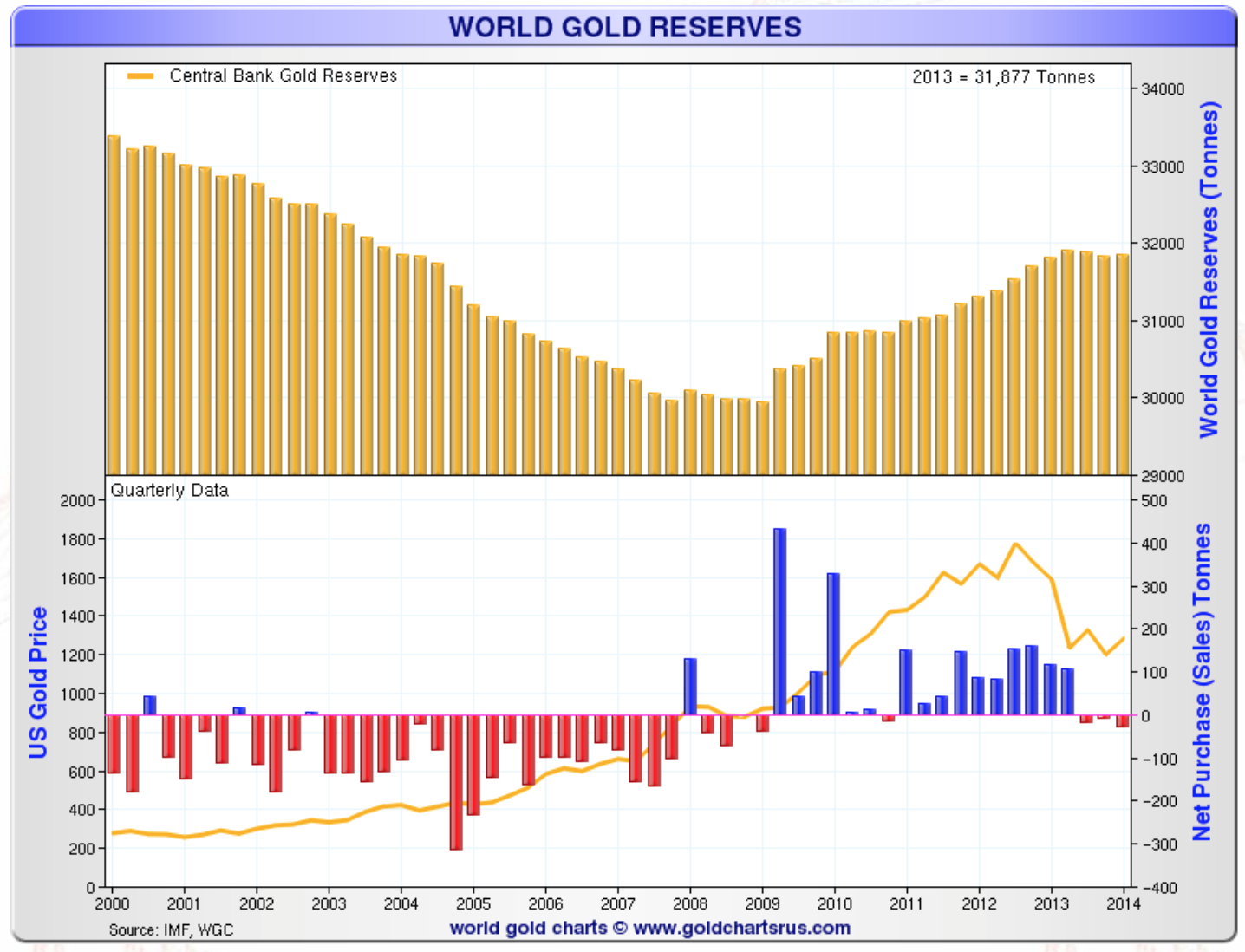

6. Two Factors that Could Send Gold Prices Higher

In a recent article, Profit Confidential says that the recent crash in China’s stock market has helped many investors realize the risk in stock investing. As a result, many investors pulled their money out of the stock market and securities investment funds. Where would all that money go, asks Profit Confidential? Gold. Moreover, who says that gold can’t pay interest, asks Profit Confidential? A gold supermarket in Guangzhou, China, started offering gold interest on gold deposits: for every 50 grams of gold deposited, the store gives one gram of gold each year. That is a two percent interest rate on gold!

The second factor Profit Confidential states that could send the gold price higher is continuing central bank buying. Central banks around the world bought 119.4 tonnes of gold in the first quarter of 2015. Although the amount was similar to last year, this was the seventeenth consecutive quarter where central banks were net buyers of gold. Russia increased its gold reserves big-time over the past few years and continues to buy. The idea is, when a country goes through a crisis, its central bank usually hoards gold. The reason is that gold gives the central bank credibility when its economy doesn’t.

Source: Profit Confidential

7. Gold price manipulation: Who really calls the tune?

Lawrence Williams of Mineweb asks in an article if gold price is manipulated and if so then who calls the tune? He answers that virtually anything traded on an exchange of any kind is open to manipulation by those with deep enough pockets, or those prepared to take the risk of being bankrupted if massive trades on margins go wrong. However, gold is something of a special case as the principal accused manipulators of last resort are the gold establishment: central banks and governments supported by the bullion banks. Williams concludes that there certainly is some considerable evidence to suggest that the gold price has been influenced, although whether this is sufficiently conclusive to satisfy the doubters will no doubt continue to be a major debating point within the sector.

Source: Mineweb

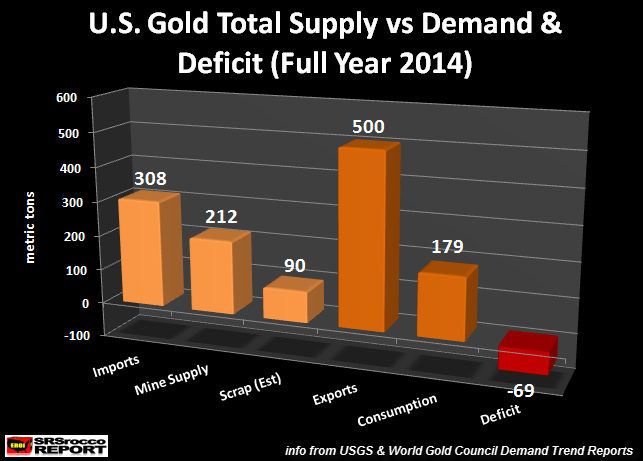

8. U.S. Suffers Large Gold Trade Deficit in Q1

The U.S. suffered a gold market trade deficit in 2014 and, 2015 looks like it will be even larger says a report by SRSrocco. According to the recent data put out by the USGS Gold Mineral Industry Surveys and the World Gold Council First Quarter 2015 Demand Trend Report, the U.S. suffered a 24.1 tonnes deficit during the first quarter of the year. This conforms again the flow of gold from the west to the east.

Source: SRSrocco Report

In conclusion, Professor Antal Feket says that "Gold that circulates inspires confidence; gold kept locked indicates lack of confidence”.

> AUDIO MP3: Click here to download

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.