I know. I am using the term “black swan” very loosely and I agree. According to Nassim Taleb to be a black swan event, it should be rare, have extreme impact and have retrospective predictability (though not prospective). However, I think China could shock the world when it announces its gold reserves. Something tells me it will have the same effect as the unpegging of the Swiss franc. Many called, also loosely, the unpegging of the Swiss franc a “black swan” event. Economists will come this time again with their statistical probability studies to show that it was a 35 standard deviation event and that such an event is likely about once every 140,000 years. I think any amount above 8,000 tonnes will be a shock in the central bank community and the gold market. Why is China accumulating so much gold? Why is China encouraging its citizens so hard to buy gold?

Being born and gone to school in a totalitarian communist country I know this massive gold buying by China is not a coincidence nor a free market choice. The images of a gold and jade statue of Mao Tse-tung worth more than $15 million in Shenzhen has an underlying message. It is the same as the picture of Vladimir Putin holding a 400oz gold bar in his hand. China is maybe not as totalitarian as it was during Mao’s reign but it still is very authoritarian. Nothing is permitted or as in the case of gold buying approved and encouraged by the powers in place without clear approval from the top. “Gold has always been, through the history of China, a way to project power,” says Kenneth Hoffman, a metals and mining analyst at Bloomberg Intelligence and I agree.

“Whoever has the most gold is able to control gold’s valuation. Controlling gold’s valuation, you can control the valuation of all other currencies,” and “The more gold China has, the less it’s under the thumb of the United States. China has got all of its foreign exchange in U.S. government bonds that could be repudiated in a minute,” says Chris Powell of the Gold Anti-Trust Action Committee (GATA). China realized this a long time ago and has been doing everything to buy gold and as much as possible.

In the Gold Forecaster of April 2014, Julian D.W. Phillips writes, “China is not only the main force in the global gold market, but they control the gold market. … They play their control very cleverly so that it is not apparent… They have found a way to buy gold without pushing up the gold price.” According to Reuters “China plans to launch a yuan-denominated gold fix this year to be set through trading on an exchange…, as the world's second-biggest bullion consumer seeks to gain more say over the pricing of the precious metal.” This will certainly increase China’s control on the gold price.

China has confirmed it has asked the International Monetary Fund (IMF) managing director, Christine Lagarde, during her recent visit to China to include China's yuan in the Special Drawing Rights (SDR) basket.

Chinese Vice Premier Li Keqiang meets with International Monetary Fund managing director Christine Lagarde

China also has been signing trade deals all over the world in the last year at a very fast pace and at the beginning of this year it has made official and public its intention to make the yuan a world currency. It caught many in the currency markets by surprise but not me.

The incredible success of the Asian Infrastructure Investment Bank (AIIB) was also a surprise and a major defeat for the US. Recently also China, through one of its banks (Bank of China), started to advertise internationally the use of the yuan. Look at an advertising billboard bellow of Bank of China in Thailand (figure #1). Note the coin is clearly a gold one and the message: “RMB [yuan] The World Currency”. This appeared a few weeks just before the announcement that China has requested the yuan to be included in the SDR.

Bank of China advertising billboard in Thailand

China officials talk frequently of gold as money and of considering gold as an asset to back their currency in one form or another. Sun Zhaoxue, president of both the China National Gold Corp. and the China Gold Association said in an article that, “Individual investment demand is an important component of China’s gold reserve system; we should encourage individual investment demand for gold. Practice shows that gold possession by citizens is an effective supplement to national reserves and is very important to national security.”(1) He also said, “Increasing gold reserves should become a central pillar in our country’s development strategy. International experience shows that a country requires 10% of foreign reserves in gold to ensure financial stability, while achieving high economic growth concurrently.” (1) Kenneth W. Hoffman, senior analyst in metals and mining at Bloomberg Industries, says that, “based on conversations with officials in China and Mongolia, it’s evident that China feels they want as much gold as the U.S.”

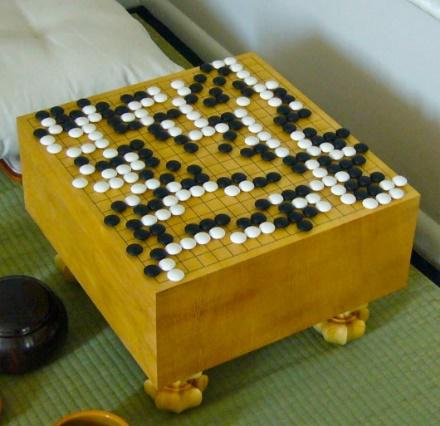

There is a game that the Chinese play, it is called Weiqi, and it is similar to chess. In Weiqi, you have to surround your enemy slowly and lay a trap, and then close the trap all at once. That is the way the Chinese think. They don’t really disclose what their plan is; they just move tiny pieces around the board in a seemingly incoherent way, but when all the pieces are lined up that’s when the trap is sprung. All of the government party leaders play this game, and the CEO’s and chairman of China’s largest businesses are all part of the party. If you observe China’s actions in the last 5 years you can clearly see this game strategy being implemented.

Weiqi

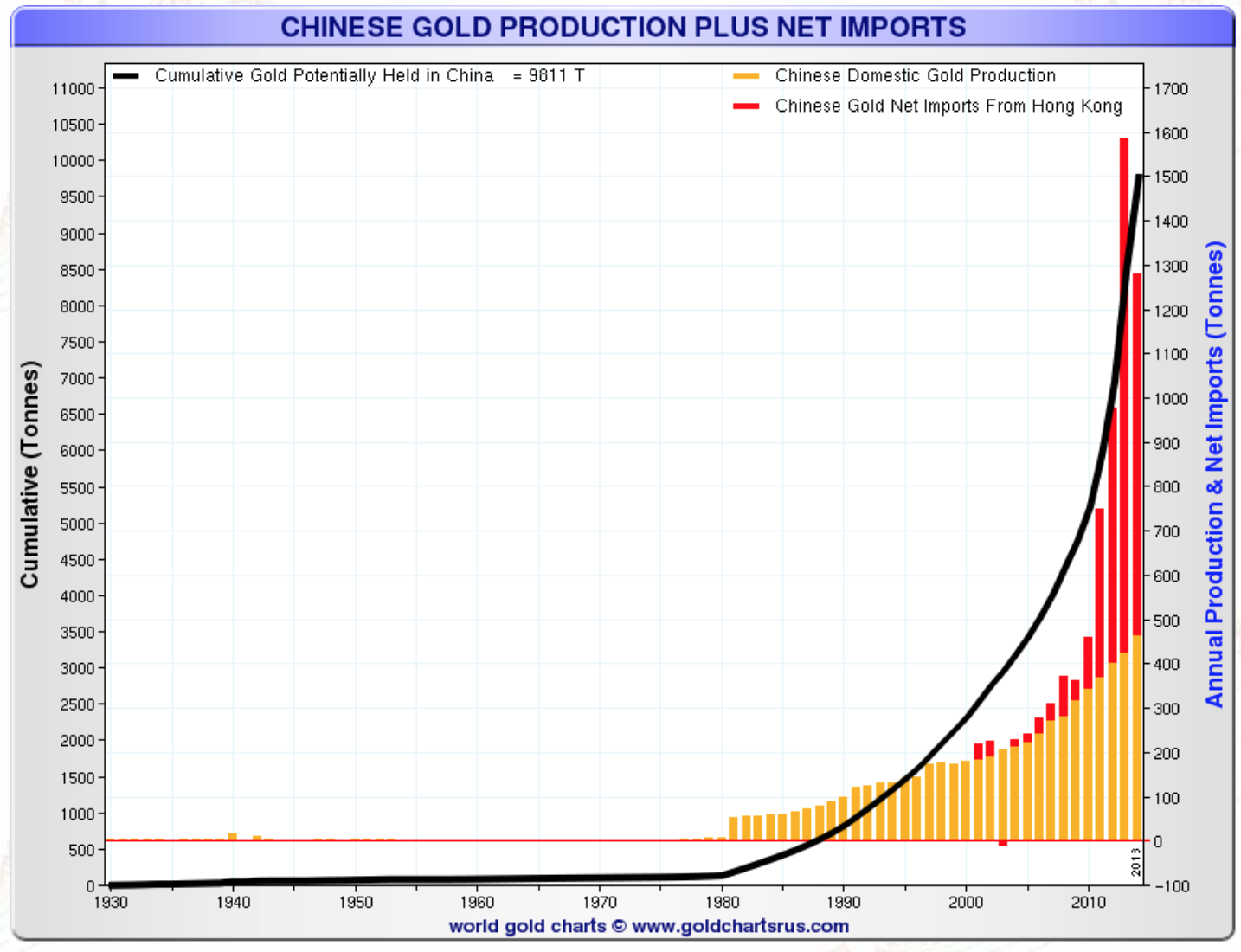

According to Willem Middelkoop, in his book The Big Reset, as early as 2009 a ‘task force’ team of monetary experts had suggested that China’s gold reserves should be increased to 6,000 tonnes by around 2013 and to 10,000 tonnes by around 2017. 6,000 tonnes would “put the Chinese on a par with the US and Europe on a gold-to-GDP ratio”.

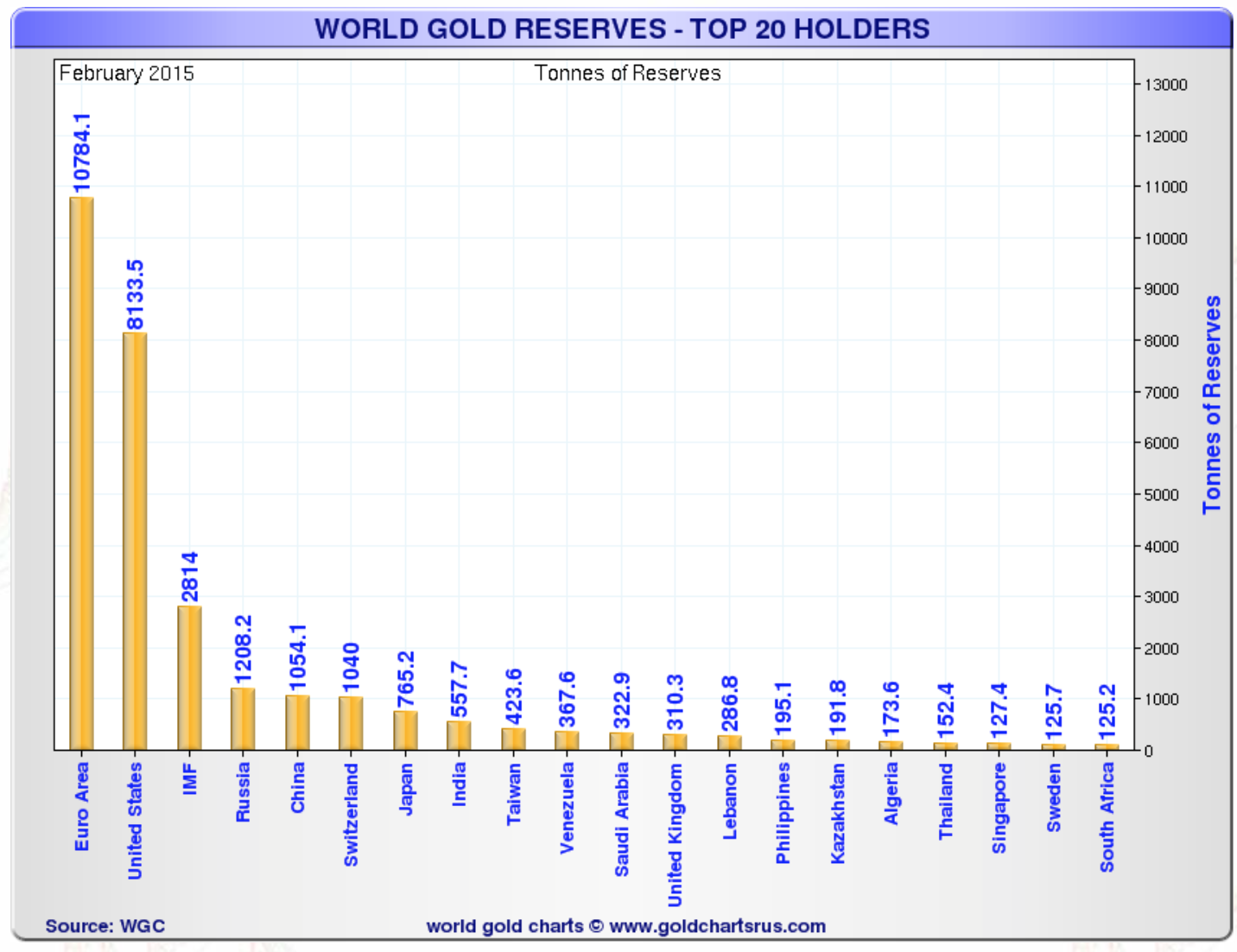

Song Xin, Party Secretary and President of the China Gold Association, wrote at Sina Finance on July 30, 2014 “in order for gold to fulfill its destined mission, we must raise our gold holdings a great deal, and do so with a solid plan. Step one should take us to the 4,000 tonnes mark, more than Germany and become number two in the world, next, we should increase step by step towards 8,500 tonnes, more than the US”. Therefore, a reasonable speculation, but still a speculation, would be that China has around 4,000 and 6,000 tonnes of gold in its possession already.

China understands the old saying that “He who owns the gold makes the rules.” In his book, The Big Reset, Willem Middelkoop says, “They [Chinese] know, even from their own history, that gold has been used time and again to rebuild faith when a fiat money system has reached its endgame.” People’s Bank of China’s Zhang Jianhua said, in an interview, “No asset is safe now. The only choice to hedge risks is to hold hard currency – gold.”(1) Sun Zhaoxue also said in an article that, “Currently, there are more and more people recognizing that the “gold is useless” story contains too many lies. Gold now suffers from a ‘smokescreen’ designed by the US, which stores 74% of global official gold reserves, to put down other currencies and maintain the US dollar hegemony.”(1)

Chart #1: World Gold Reserves – Top 20 Holders

If we look at the next chart, we cannot not be impressed by the rapid accumulation of gold by China, wonder how much went into private ownership, and how much is directly under the control of the People's Bank of China (PBOC) as official reserves.

Chart #2: Chinese Gold Production Plus Net Imports

What can we conclude from the recent official request by China to include the yuan into the SDR basket? Can we consider that an announcement of the most recent China gold reserves will be made before the inclusion of the yuan into the SDR? If yes than an announcement by the end of the year is almost certain. If the yuan were to be included into the SDR, China would have to show the composition of its foreign exchange reserves. That implies also to furnish detailed information about its official gold holdings.

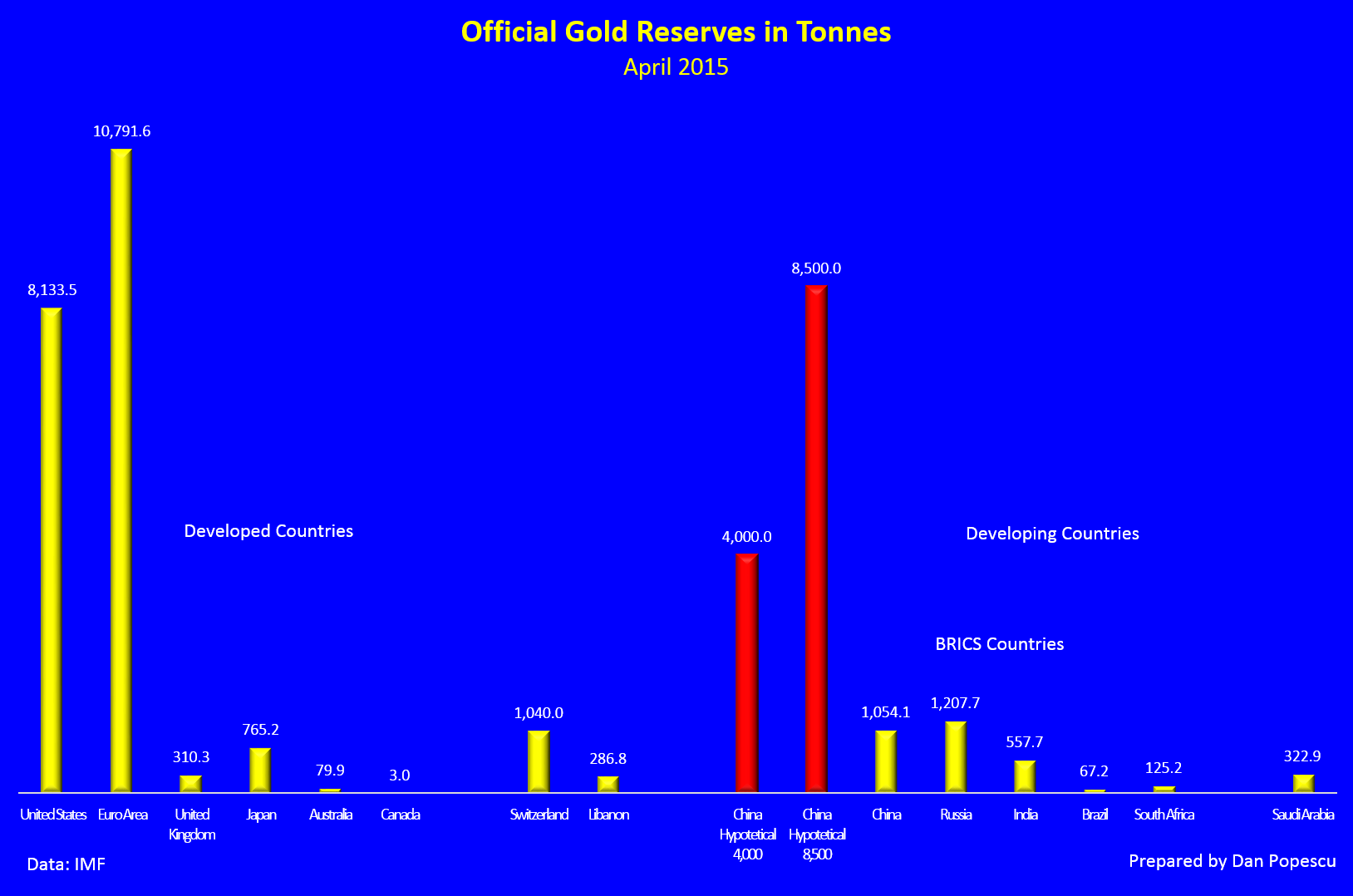

In the next three charts I have showed the official gold reserves of the G7, BRICS and two small but special countries, one developed, Switzerland and one developing, Lebanon. Both have a very unusual gold portion of their foreign exchange reserves. I also included two hypothetical scenarios for China since the official figure of 1,054.1 tonnes has not been updated since 2009 and is unrealistic. The first scenario is that China will announce 4,000 tonnes of gold reserves and the second scenario is an announcement of 8,500 tonnes. As you can see to join the majors, US and Euro Area, China needs at least 4,000 tonnes (Germany has 3,384.2 tonnes) but I prefer to look at Germany as part of the Euro Zone).

Chart #3: Official Gold Reserves in Tonnes

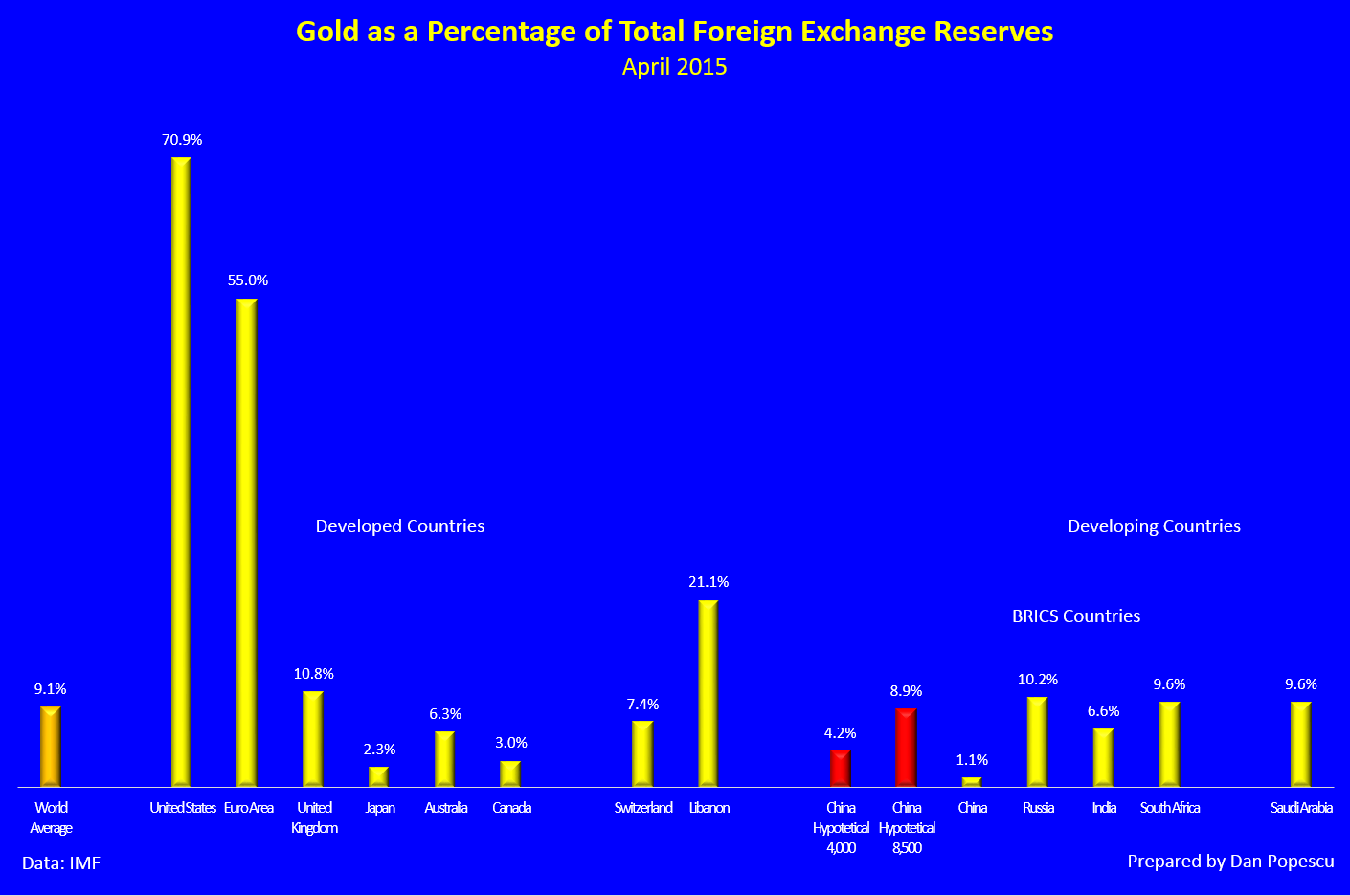

If we look at gold as a percentage of foreign exchange reserves, at 4,000 tonnes China is still far from the majors, Euro Area and US. With 8,500 tonnes, China’s gold will represent only 8.9% while the US and Euro Area 70.9% and 55% respectively. Even Russia already has 10.2%.

Chart #4: Gold as a Percentage of Total Foreign Exchange Reserves

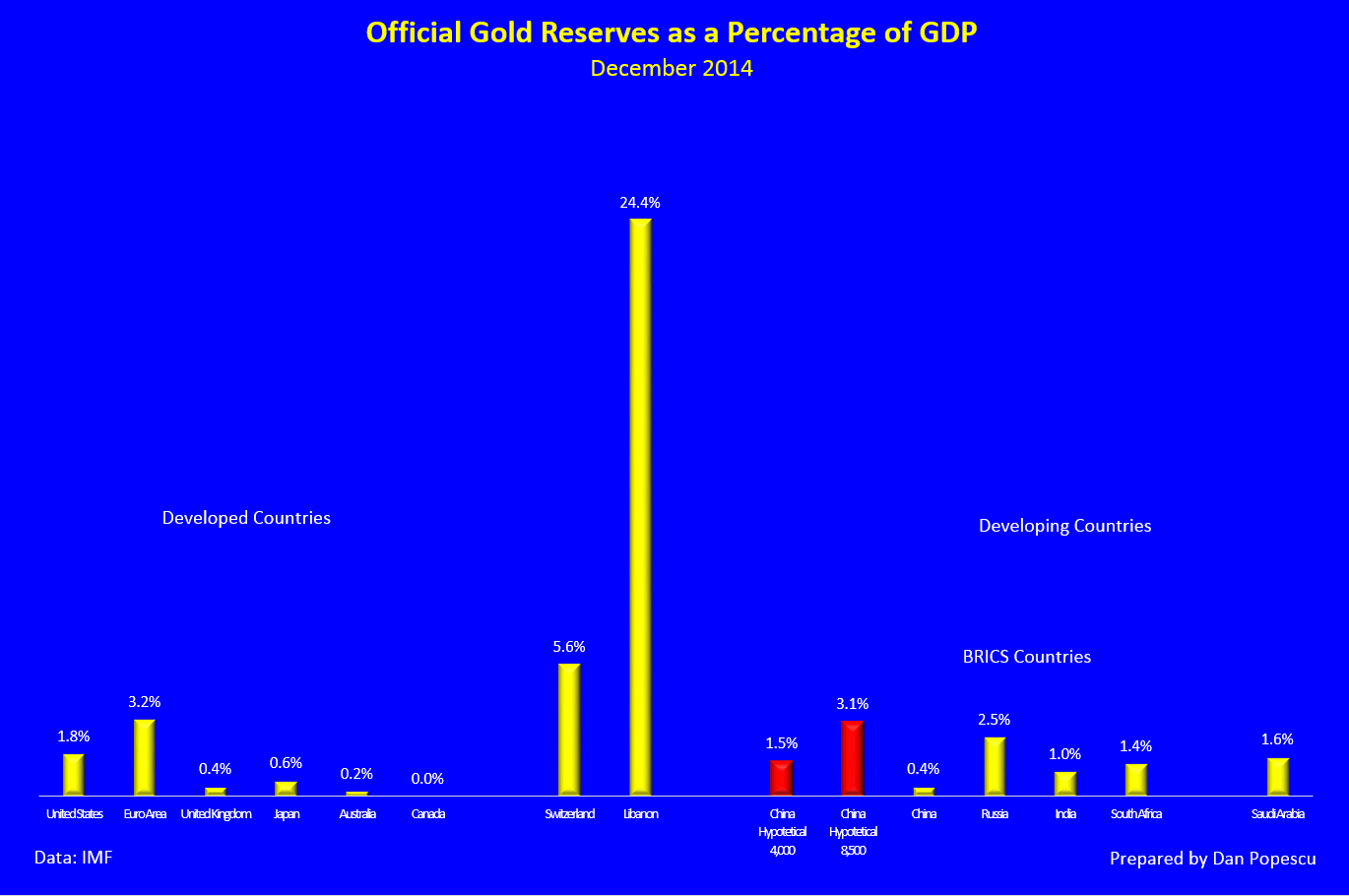

Now, if we look at the gold reserves as a percentage of gross domestic product (GDP) then at 8,500 tonnes China would be higher than the US’s 1.8% but less than the Euro Area’s 3.2%. On the other hand, with just 4,000 tonnes, it will be close to the US’s 1.8% but still lower.

Chart #5: Official Gold Reserves as a Percentage of GDP

It is evident that any announcement of 8,000 tonnes of gold or more would create a shock in the gold market but also in the central bank community. This will be what I call loosely a “black swan” event. It will start a run on gold by other central banks as it happened when France repatriated all its gold in 1970 and was followed by many other countries forcing US President Nixon to close the gold window. I do not expect such a shock, if the announcement is only between 4,000 and 6,000 tonnes since it is already widely accepted in the market. However, I would not be surprised if besides this 4,000 to 6,000 tonnes, China also has access indirectly to another 2,000 to 4,000 tonnes already.

Bibliography:

Charts:

-

Nick Laird, www.sharelynx.com

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.