The macroeconomic event of the week comes from Japan, where the yen recorded its lowest level against the US dollar since 1990.

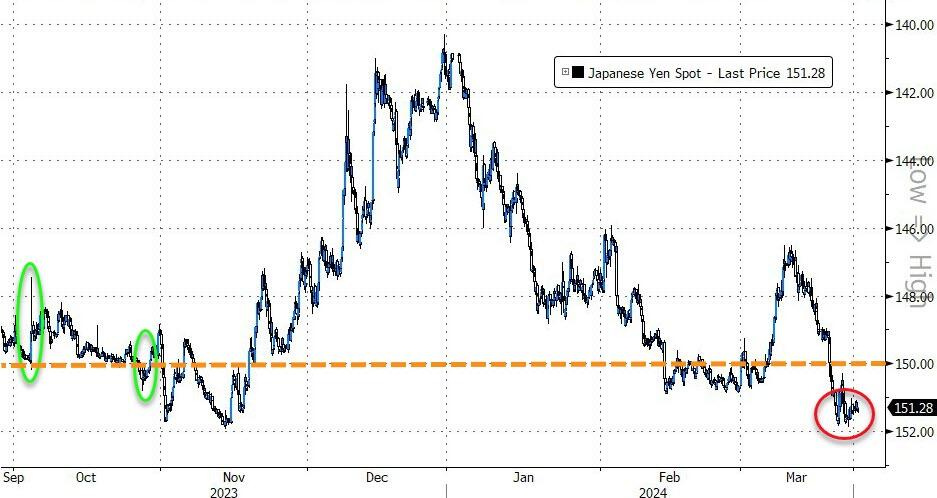

The dollar is at a 34-year high against the Japanese currency. The resistance level of 150 yen to the dollar is about to be breached, a level which historically served as support in the 1980s. If this resistance is overcome, the dollar could rapidly climb to levels not seen in Japan for a generation:

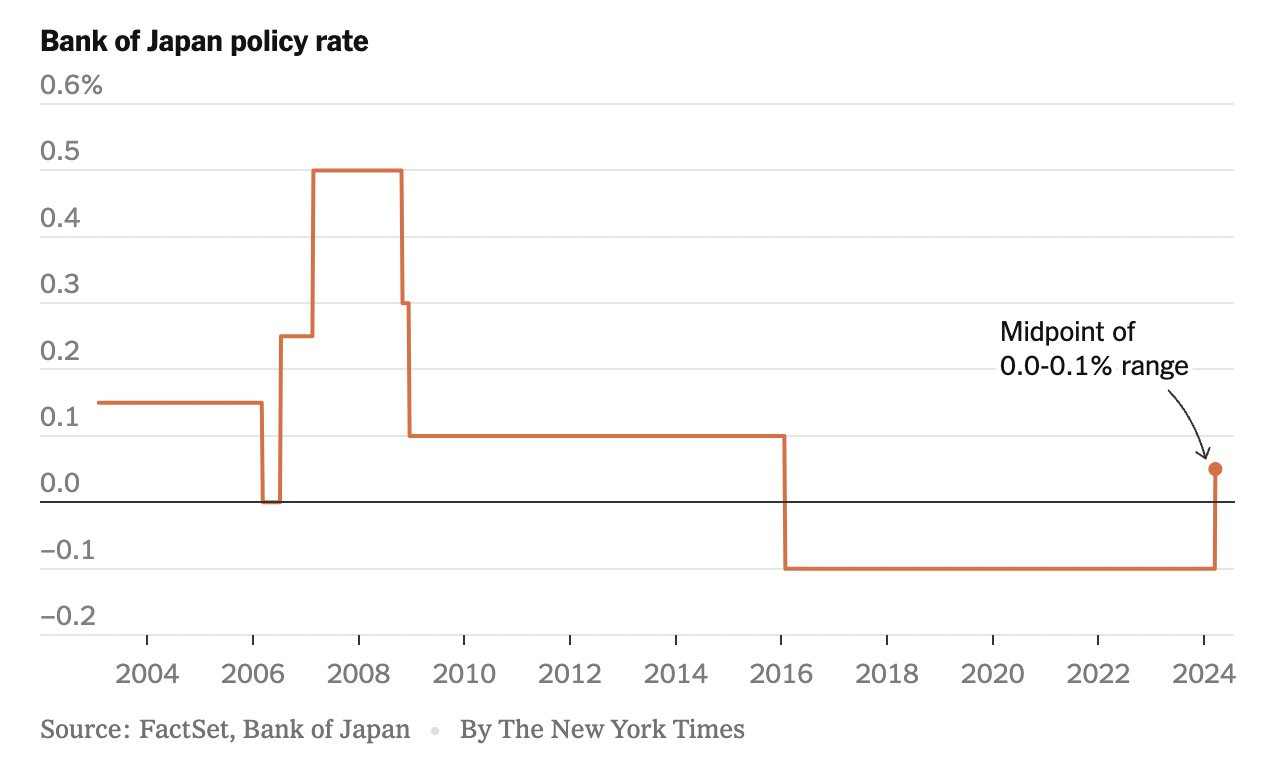

This record high for the dollar against the yen comes as the Governor of the Bank of Japan (BoJ) has just announced the end of the negative interest rate policy.

The BoJ's announcement not only failed to support the yen, it actually accentuated its decline. Investors did not consider the BoJ's speech to be sufficiently firm to defend the value of the currency:

The mini rate hikes seem insufficient to change the situation:

This new bout of weakness after the rate hike announcement clearly displeased the Bank of Japan. Japan's top foreign exchange official is threatening to "take appropriate measures" against "short speculators". A ban on shorting the yen is therefore in the works. A central bank that defends its currency by banning short selling sends a signal to the market. Other countries have used this kind of technique in the past, without much success.

The market seems to have realized that behind the tough talk lies a very special paradox. Indeed, although defending the yen is officially a national issue, the slow erosion of the Japanese currency is ultimately a rather positive operation for Japan.

Firstly, a sharp rise in interest rates would be unsustainable given the burden of public debt. With a debt exceeding 200% of GDP, it is in Japan's interest to keep interest rates very low to avoid an explosion in the debt burden. The aim is to let inflation gradually erode this colossal debt. However, the monetization of Japan's debt over the past 20 years is beginning to have a direct impact on the country's inflation rate. The Bank of Japan therefore runs a growing risk of seeing inflation accelerate sharply. Inflation needs to absorb this monetization, but not too quickly.

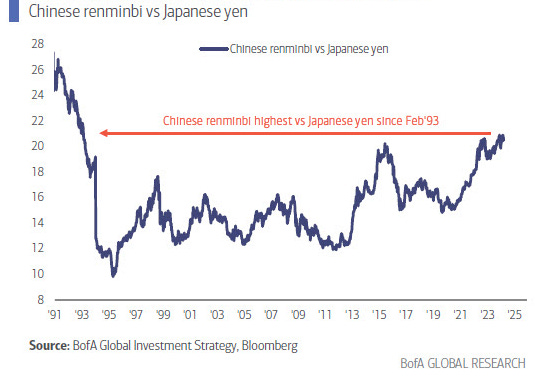

Another challenge for Japan comes from China. While the dollar is at a record high against the yen, the renminbi is also at a record high against the yen for the first time since 1993:

To maintain its competitiveness against Japan, China has no choice but to engage in a competitive devaluation of its currency.

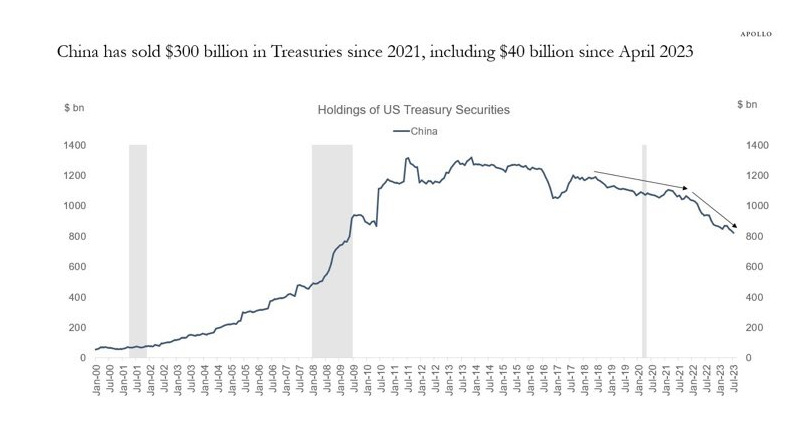

This devaluation means continuing to get rid of US Treasuries. China's sale of US Treasuries is likely to accelerate further in the midst of a currency war:

Japan must intervene to support its currency and control inflation, but must also ensure that China does not regain a competitive edge with its next currency devaluations.

The dual situation of the BoJ's stalemate - whose credibility is currently being tested by the markets - and the ongoing currency war are clearly benefiting gold.

Gold's surge in yen terms is particularly spectacular:

This chart of gold in yen is beginning to resemble those of gold against other fiat currencies that have collapsed in recent years, as was recently the case with the Turkish lira.

Faced with the risk of a collapse in the value of their fiat currency reserves, it makes sense for central banks to step up their gold purchases.

This movement has effectively intensified in recent months.

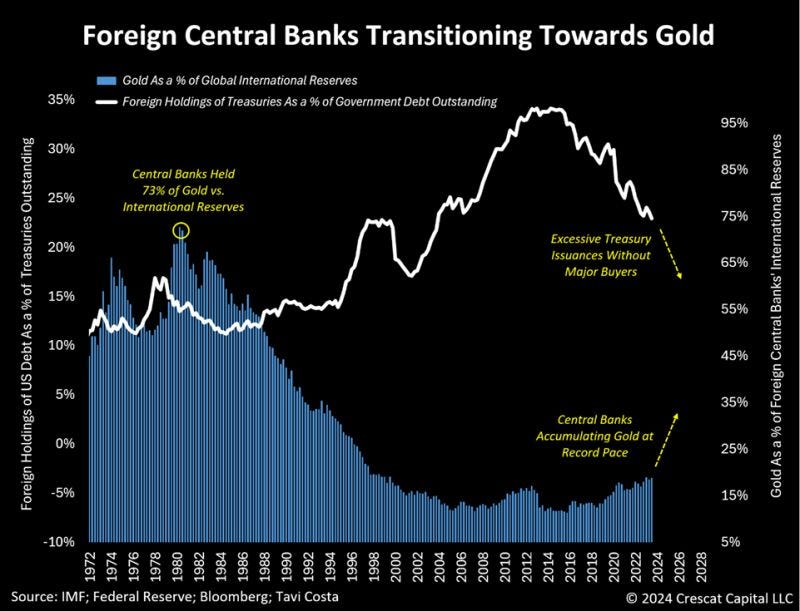

Otavio Costa recently published a captivating chart illustrating the transition of central banks into gold. It clearly shows that these institutions are buying gold at the same time as they are disengaging from the sovereign bond market:

Central banks' confidence in the ability of currencies to retain the value of these debt instruments is being eroded, which largely explains gold's current rise.

This loss of confidence particularly affects heavily indebted countries, especially those facing the debt wall, the mechanisms of which we have detailed in previous articles.

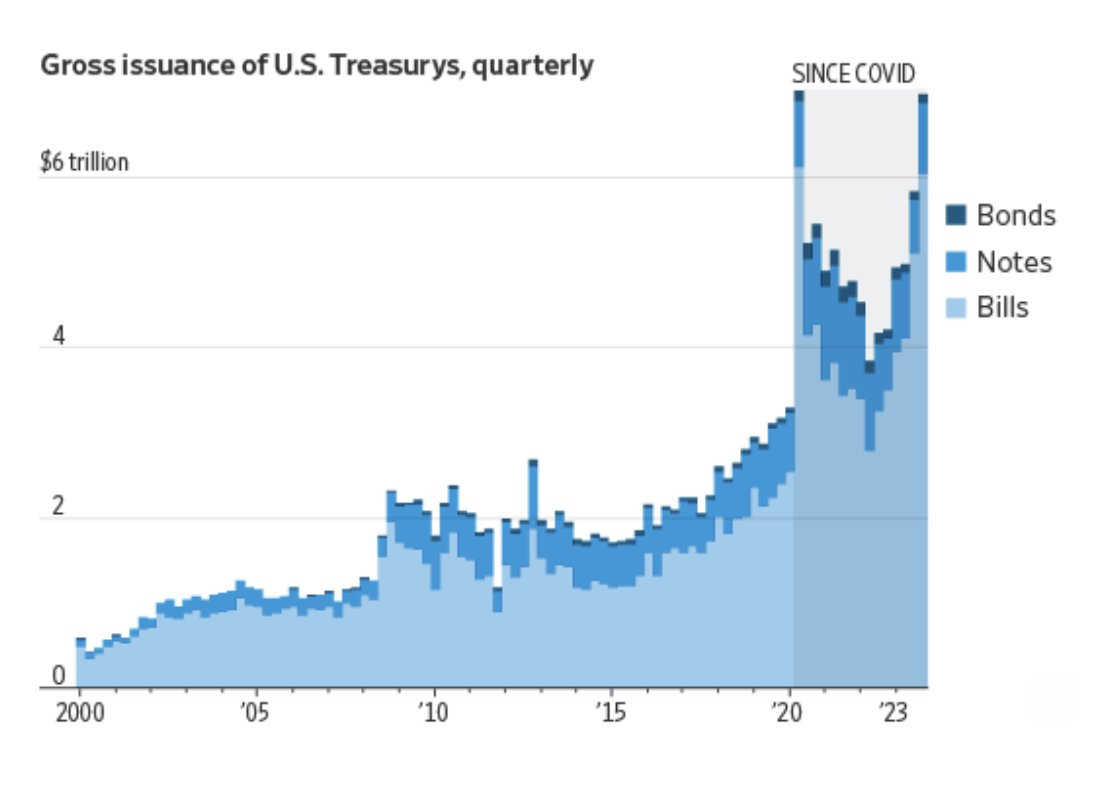

At a time when central banks are turning away from debt securities, the United States is issuing a record volume of short-term bonds to refinance its debt. The United States is currently soliciting the market as intensively as it did during the COVID-19 crisis:

Monetary intervention is likely to increase as Treasury auctions also accelerate. Volatility on the foreign exchange market is likely to increase, and the gold market is not likely to be spared this renewed volatility.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.