France is known for having the 4th largest stock of gold in the world, even though the country ranks 23rd in wealth per capita. In fact, over 2,400 tons of gold, or €146 billion at €60,000/kg, are stored in the vaults at 39 Rue Croix des Petits Champs in Paris. But do the French own so much gold privately?

In the home, gold takes many forms: coins and bars, jewellery, but also technology. While the French seem to be investing more and more in gold since 2019, demand for gold for jewellery has been sluggish in France in recent years. Even so, it appears that the French are at the head of a small, historic treasure trove.

Between 40 and 75 grams of gold per French person?

Under the gold standard, the French were systematically exposed to the yellow metal. But since the end of the 20th century, French savings have been proportionally less exposed to gold, since it's up to each individual to determine his or her exposure to precious metals. Nevertheless, what is the proportion of physical gold in French assets, almost half a century after the end of the gold standard?

We know that the average French person will have an average of €91,000 in savings and financial assets in 2023, according to data from the Banque de France (BdF). While we know how much French people hold in equities, passbooks and other investments, the question becomes much more delicate when it comes to household gold holdings, which are not mentioned by either Insee or the BdF.

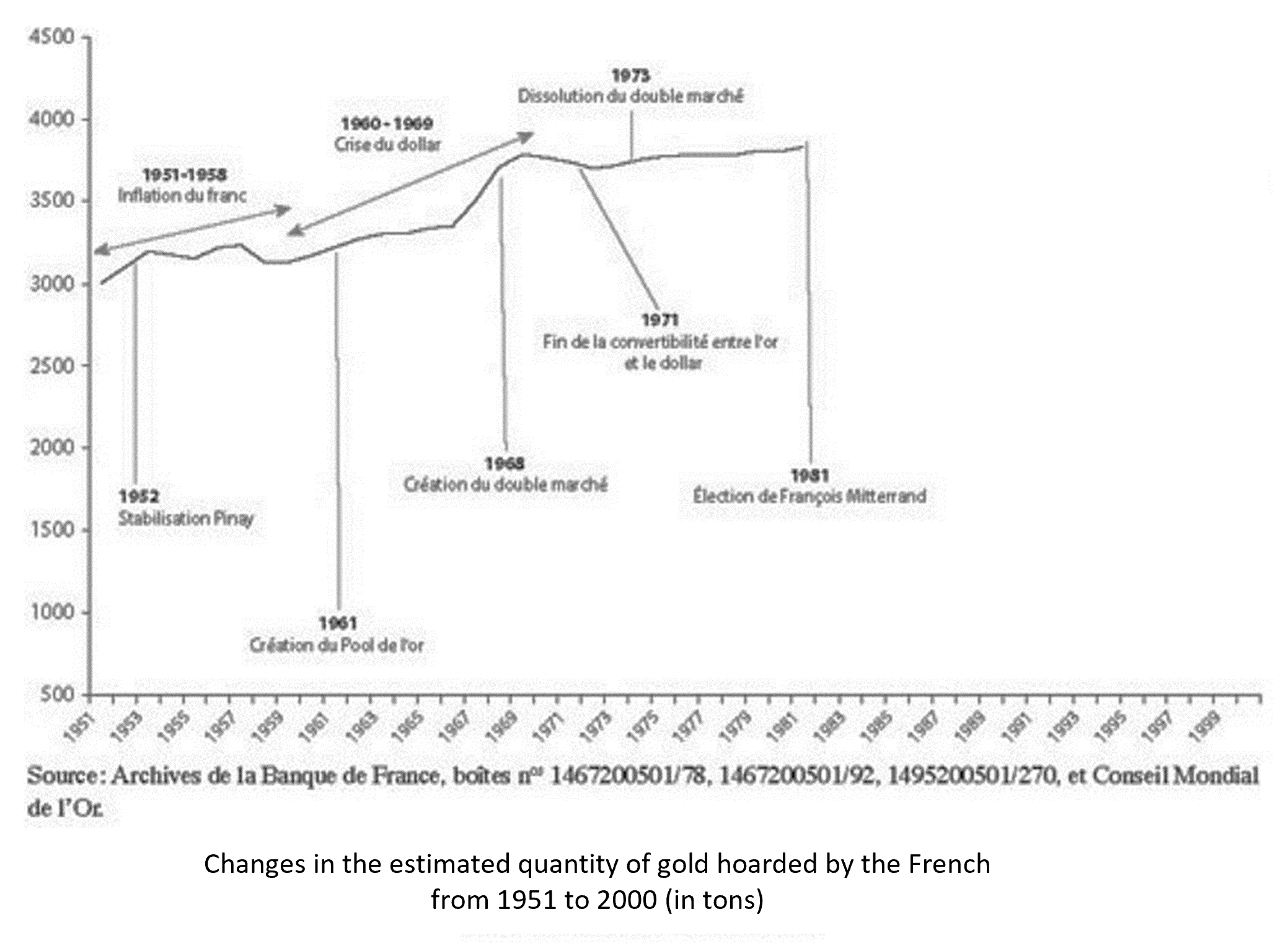

The question of the quantity of gold held by the French has been the subject of much research and estimation, in particular by Thi Hong Van Hoang (2012), notably on the basis of old BdF documents. The author reveals that, despite the definitive demonetization of gold in 1978, "gold continues to be hoarded in France". Thus, the quantity of gold held by the French in 2000 was between 3,000 and 5,000 tons. We can also assume that the French have added a few dozen tons to their treasury since 2000 (37 tons if we consider average investment demand since 2010). What's more, 50 years ago, the Banque de France reported that most of this gold was in the form of coins (up to 80%), a proportion that is probably similar today.

Clearly, assuming that the French hoard 4,000 tons of gold (60 grams per French person), this would be equivalent to estimating that each French person would hold an average of €3,600 in gold, at a price of €60,000 / Kg. In other words, less than 4% of the average French person's financial savings would be stored in gold by 2023. Whether realistic or not, these estimates give an idea of the quantities of gold held by each individual. What's more, it's interesting to note the evolution of French people's behavior towards gold in recent years.

The French are buying more and more coins and ingots

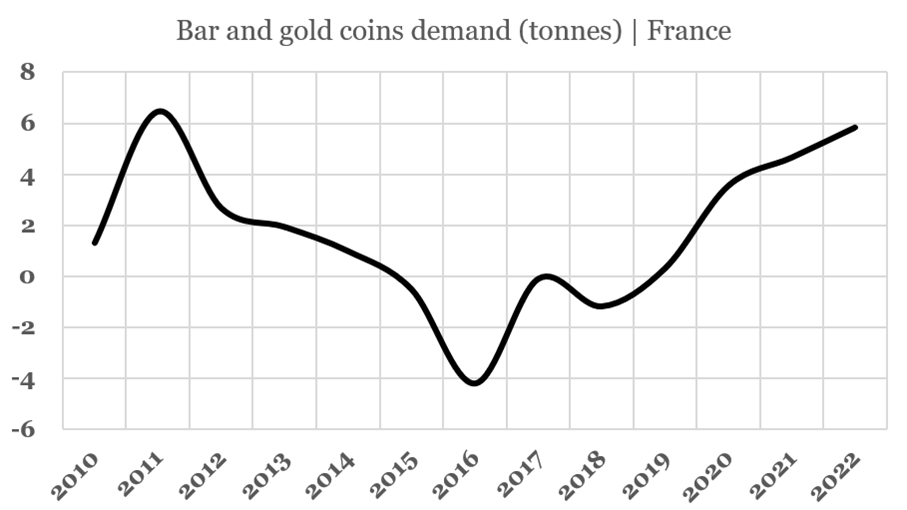

According to data provided by the World Gold Council, demand for coins and ingots in France reached almost six tons in 2022 (or 0.086 grams per French person). This figure may seem low, given that demand in Switzerland is close to 50 tons, while demand in Germany exceeds 180 tons. The graph below shows the evolution of demand for coins and ingots in France since 2010:

It's clear that the attraction of investing in gold for the French is directly correlated to the price of the yellow metal. Between 2014 and 2019, the French sold investment gold (at a low), before driving a new buying movement that continues into 2023. In recent years, the French have rediscovered their interest in buying coins and bullion.

To get a better idea of French demand for gold investments, we've based our calculation on the famous Napoléon 20 francs coin, which will be worth around €365 in January 2023. So, when a French person buys the equivalent of one Napoleon 20 franc coin in 2022, this represents the average global demand of 75 French people! In other words, the proportion of French people who buy investment gold is extremely low, since it would be enough to buy one Napoleon 20 francs to cover the annual investment gold demand of 75 inhabitants in 2022.

Are the French buying less and less gold jewellery?

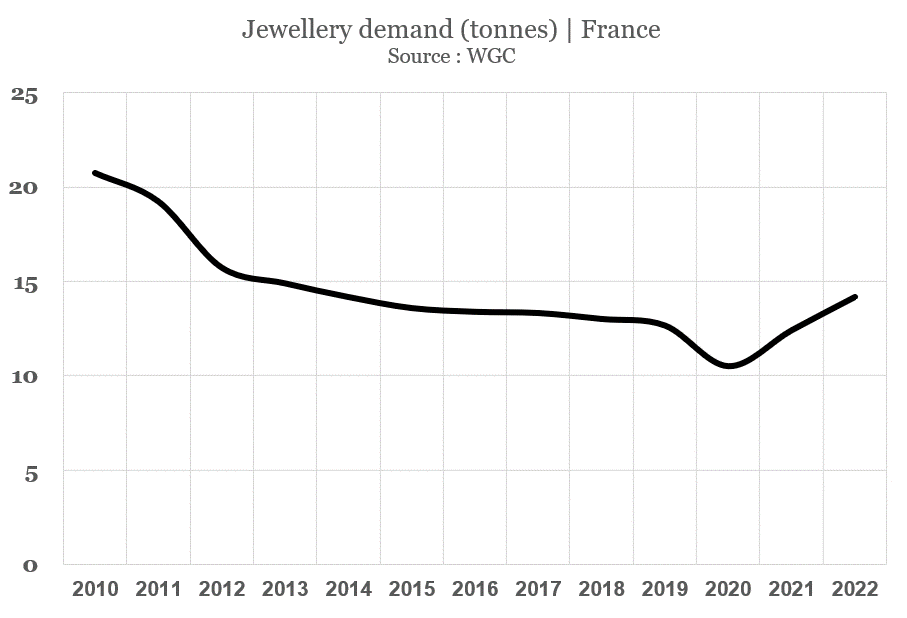

Since 2010, according to the World Gold Council, demand for gold for jewellery in France has fallen by nearly 32% (and by up to 50% during the COVID). At the same time, the number of jewellery wearers in France is shrinking. So is it simply a question of fashion (in favor of costume jewellery or other metals), security concerns, or a real crisis in purchasing power? In fact, the downward trend in demand for gold in jewellery seems to have faded since 2021. Between 2020 and 2022, jewellers' sales will have risen by +84%, after stagnating for a long time between 2010 and 2018. While gold demand in France for jewellery has declined over the past ten years, the trend now seems to be stabilizing:

Inflation also affects the jewellery sector. In 2022, the consumer price index for watches and jewellery rose by +4.7%. In addition, the first three quarters of 2023 will see a stagnation in demand for gold for jewellery. By way of comparison, Europe's biggest demanders of gold for jewellery are Italy and the UK (with 19.4 and 19.3 tons in 2022). Germany, on the other hand, has a lower demand than France. As a result, while the French have rediscovered their love of jewellery in recent years, the effect on gold demand remains moderate.

Countries with the highest demand for gold

Overall, when we look at aggregate demand for jewellery and investment, the French have doubled their demand for gold since 2016. But the demand for gold in France in 2022 (close to twenty tons) only allows a return to 2012 levels. In other words, French interest in gold seems to depend largely on the price of gold itself (demand increases as the price rises). But we must also take into account the demand for jewellery, which is more dependent on fashion effects, the feeling of security, and purchasing power.

|

Average gold consumer demand per capita (2010-2022, yearly, in grams). Source : WGC |

|

|

Switzerland |

6.53 |

|

UAE |

6.19 |

|

Hong Kong SAR |

5.95 |

|

Kuwait |

3.40 |

|

Singapore |

2.78 |

|

Saudi Arabia |

2.20 |

|

Germany |

1.66 |

|

Turkey |

1.39 |

|

Austria |

1.31 |

|

Australia |

1.29 |

|

Thailand |

1.04 |

In total, French demand for gold in 2022 was around 0.3 grams per capita... Which ranks France 25th according to the World Gold Council, roughly the country's position in terms of wealth per capita. Far ahead of France, the United Arab Emirates and Switzerland each had a demand for 5.6 grams of gold per capita in 2022. But clearly, on a global scale, Switzerland has the highest average per capita demand for gold (6.5 grams per year on average since 2010).

Countries with the highest gold reserves

We have discussed private gold reserves in France, and have shown that they are probably greater than the gold reserves held by the Banque de France. What's more, it appears that the countries of old Europe, such as Switzerland, Italy, Germany and France, have a much higher gold reserve per capita held by their central banks than the rest of the world. The world champion in gold reserves per capita remains Switzerland, whose central bank holds the equivalent of 116 grams of gold per inhabitant. Similarly, Italy and Germany hold around 40 grams per capita, compared with 36 grams in France.

|

Gold Reserves per capita (grams) |

|

|

Pays |

Réserve d'or / habitant |

|

USA |

24.28 |

|

Germany |

39.62 |

|

Italy |

41.75 |

|

France |

36 |

|

Russian Federation |

15.9 |

|

China |

1.55 |

|

Switzerland |

116.85 |

The United States, with the world's largest gold reserves (over 8,100 tons), comes in 5th place with 24 grams of gold per capita. Far behind are Russia with 16 grams, and China with just 1.5 grams of gold per capita, according to official reserves.

Therefore, if we add the 60 grams of gold held privately by each French person, we can conclude that the French have one of the highest gold holdings in the world (with over 90 grams per person). As in the case of France, some estimates suggest that the stock of gold hoarded in the United States could be as high as 26,000 tons. In total, the Americans would have a stock (private and federal) of 77.6 grams of gold per capita, which would still be less than that of the French. Similarly, the Indians would have a hoard of almost 25,000 tons. It is clear, therefore, that most of the world's gold is in private hands, contrary to what some might suppose.

Storing gold to keep your place in history

Because of its historical power, France handled a considerable quantity of gold: millions of Louis were minted between 1640 and 1792, and a further 515 million Napoleons 20 francs (including 118 million Coqs) between 1803 and 1914. Napoleon III alone accounts for almost half of the 515 million "Napoleons" minted between 1803 and 1914, which required no less than 3,000 tons of gold. While much of this gold has been recast, resold or reused, it is clear that the French still retain a material legacy.

The question of gold stocks has always fascinated us, and we find traces of estimates as far back as the first millennium BC. Thus, the Old Testament mentions in chapter 10 of the Book of KINGS, on "the wealth and wisdom of Solomon":

"Each year Solomon received about 25 tons of gold. This did not include the additional revenue he received from merchants and traders, all the kings of Arabia, and the governors of the land [...] And all king Solomon's drinking vessels were of gold, and all the vessels of the house of the forest of Lebanon were of pure gold; none were of silver: it was nothing accounted of in the days of Solomon".

- Old Testament, Book of Kings, X.

If as much gold flocked to Solomon 3,000 years ago as to the French in 2022, isn't that a tremendous lesson from history? A 2019 World Gold Council survey revealed that "gold is a common choice - the third most regularly purchased investment, with 46% of global retail investors choosing gold products, just behind savings accounts (78%) and life insurance (54%). When it comes to jewellery, the survey shows that 56% of consumers have bought fine gold jewellery, compared with 34% who have bought platinum jewellery".

In conclusion

In short, we have shown that :

- France holds one of the world's largest stocks of gold. The Banque de France holds the equivalent of 36 grams of gold per French person.

- But the French probably hold more gold privately, certainly between 40 grams and 70 grams of gold per capita according to data from the end of the 20th century.

We can visualize this stock of gold by comparing it with the financial savings of the French. Assuming that each Frenchman holds 60 grams of gold, this would equate to an average of €3,600 of gold per Frenchman, or less than 4% of all financial savings recorded by the Banque de France. In other words, it would be "sufficient" for 4% to 6% of the French population to buy a 1kg bar to represent the stock of gold currently held by the French. While it's clear that gold ownership is unevenly distributed according to age and income, the French nevertheless own enviable quantities of gold.

What's more, the French have been buying more and more investment gold in recent years. At the same time, demand for gold in the form of jewellery has been declining, although the figures may soon show a reversal of this trend. All in all, the French have one of the highest gold stocks (private and public) in the world. Switzerland, Germany, Italy and France thus belong to a category of countries with considerable gold holdings, the fruit of historical and economic legacies. While France's standard of living may be slipping in the international rankings, its heritage remains.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.