U.S. inflation figures are a cause for concern.

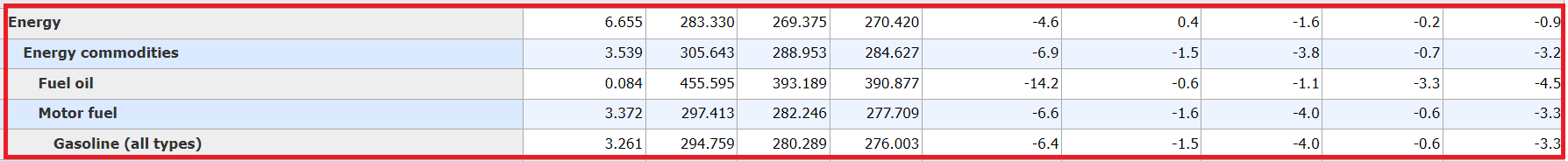

Despite a sharp fall in energy-related prices, the consumer price index (CPI) rose by 0.3% in January:

In January, the "energy" component of the CPI index fell by -0.9%, with falls of up to -4% for petroleum products. The fall in crude oil prices triggered a collapse in the price of oil-related raw materials... but this sharp decline in a component that is essential to the calculation of the CPI failed to curb the still very substantial rise in the CPI's other components.

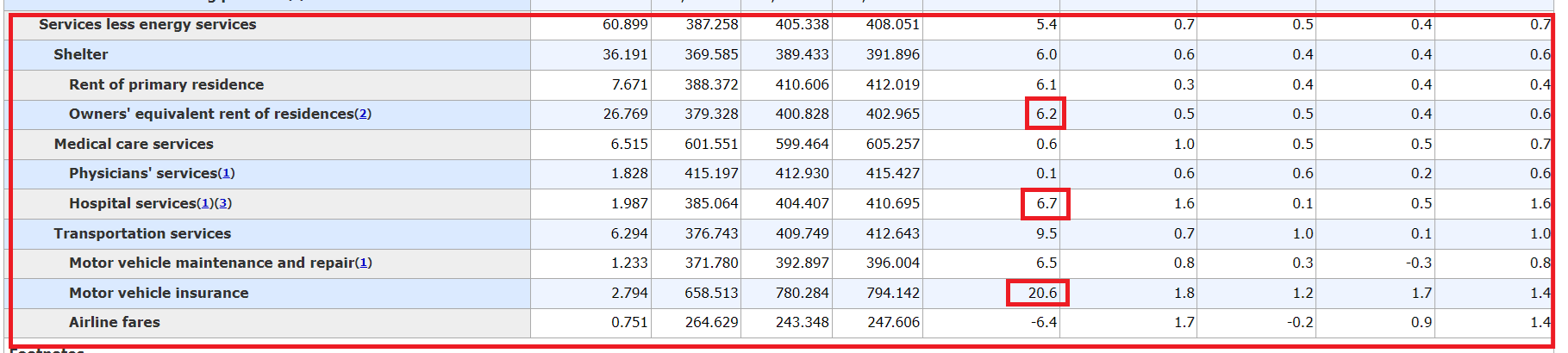

Despite the drop in energy, most prices rose significantly in January. The goods and services category even outpaced the monthly CPI index for the third consecutive month. Shelter and transportation services recorded increases of 6% and 9% respectively over the past twelve months! Car insurance has risen by +20% in the space of three months, and rents are also back on the rise. In the United States, the service sector is currently in a recovery phase, characterized by the emergence of a second inflationary wave affecting this part of the economy:

In my January article, I reported that the "Super core CPI", which excludes housing-related costs from the Core CPI, had reached an even higher level in December, standing at almost +5% annualized for the month.

The Super Core CPI index is one of the main indicators monitored by the Fed, and it showed a worrying upward trend in January.

The rebound in the Super Core CPI is underway, and looks more and more like the start of a second wave of inflation:

How does the Fed intend to justify a pivot in its monetary policy in the face of this upturn in inflation?

Investors who had anticipated a rate cut in March were taken by surprise.

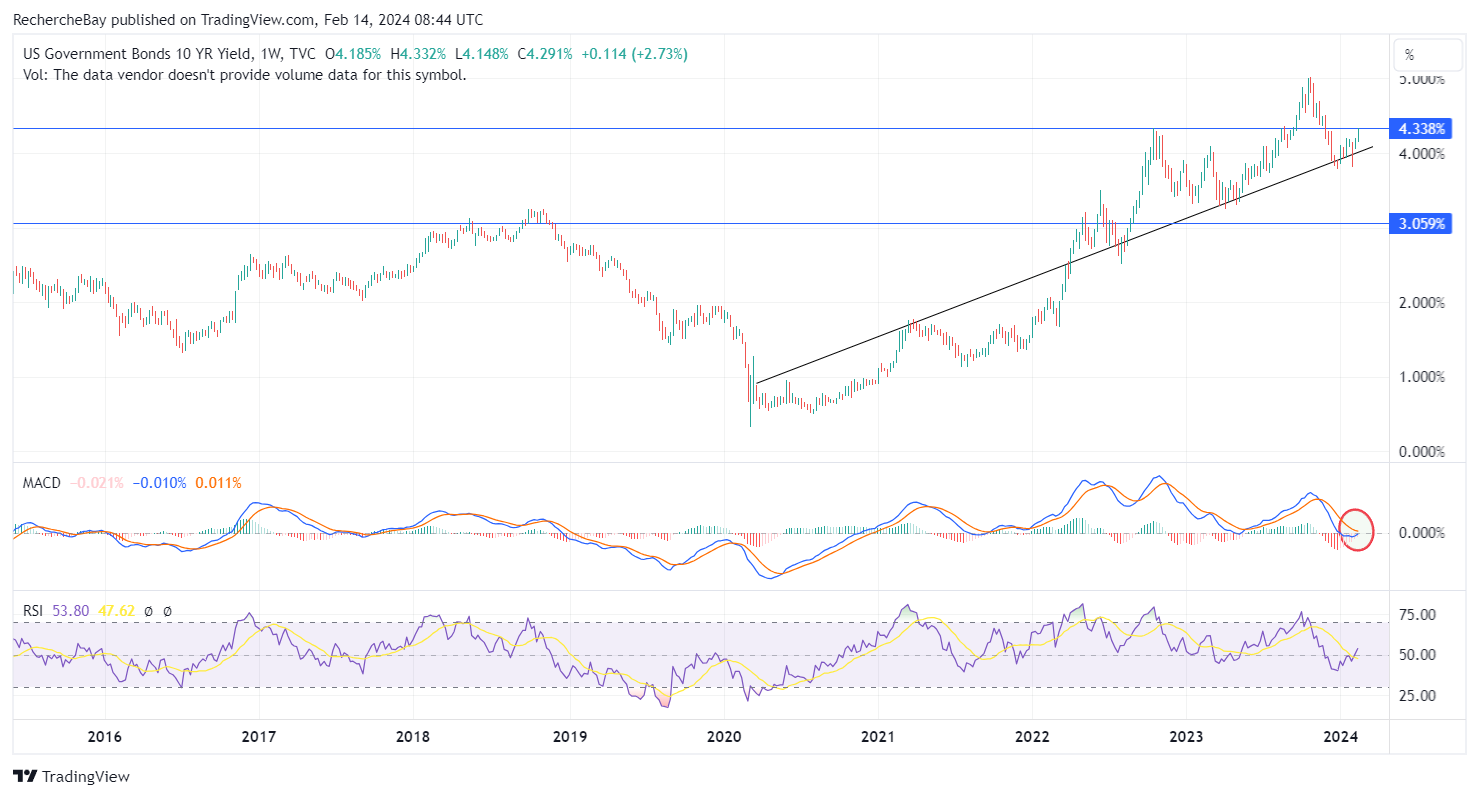

Equities fell from their all-time highs following the release of the consumer price index, while bonds sold off, with two-year yields reaching their highest level since the Fed announced its change of monetary course in December.

The U.S. 10-year is also back on the rise, again flirting dangerously with important resistance at 4.3%:

The prospect of a rate cut in the United States seems to have been postponed- or at least that's what the market is indicating.

This postponement will complicate the financing of heavily indebted companies.

This upward trend in interest rates will also complicate the refinancing of US debt.

The next few months will show whether the Fed is really independent of the Treasury. Inflation figures and the bond market should even force the Fed to raise rates in March. On the contrary, the Treasury needs lower rates to avoid debt interest costs exploding upwards and worsening the deficit in the next wave of short-term debt financing.

How can the Fed cut rates in such an inflationary environment?

Cutting rates at a time when inflation is on the rise would be confirmation of a new inflationary wave.

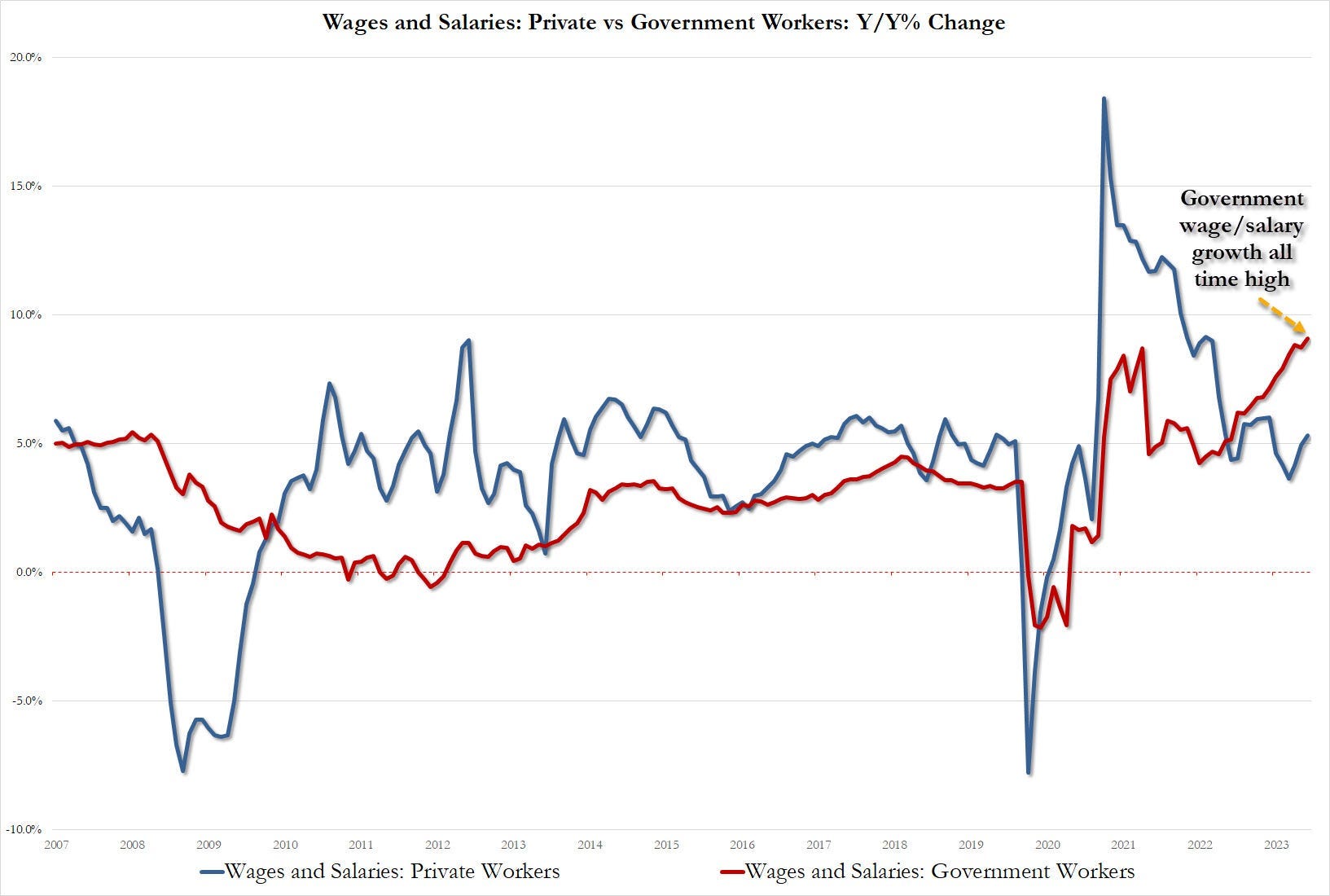

The Secretary of the Treasury seems to favour this approach. Two weeks ago, Janet Yellen said of inflation: "I think most Americans know that prices are not likely to fall”. She added another layer this week insisting that higher wages are offsetting the effects of inflation.

In other words, the effects of inflation are not a real problem, since wages have also risen. There's no point in fighting inflation as long as wages follow!

Many observers have reacted to this statement, since it is clear that the rise in wages has not been uniform across the economy since inflation began. For many Americans, wage growth is far from sufficient to offset the effects of inflation.

In my newsletter from February 2nd, I discussed the decorrelation between public and private wage levels since the onset of inflation:

Since the last rise in inflation, US public sector employees have been at an advantage over those in the private sector.

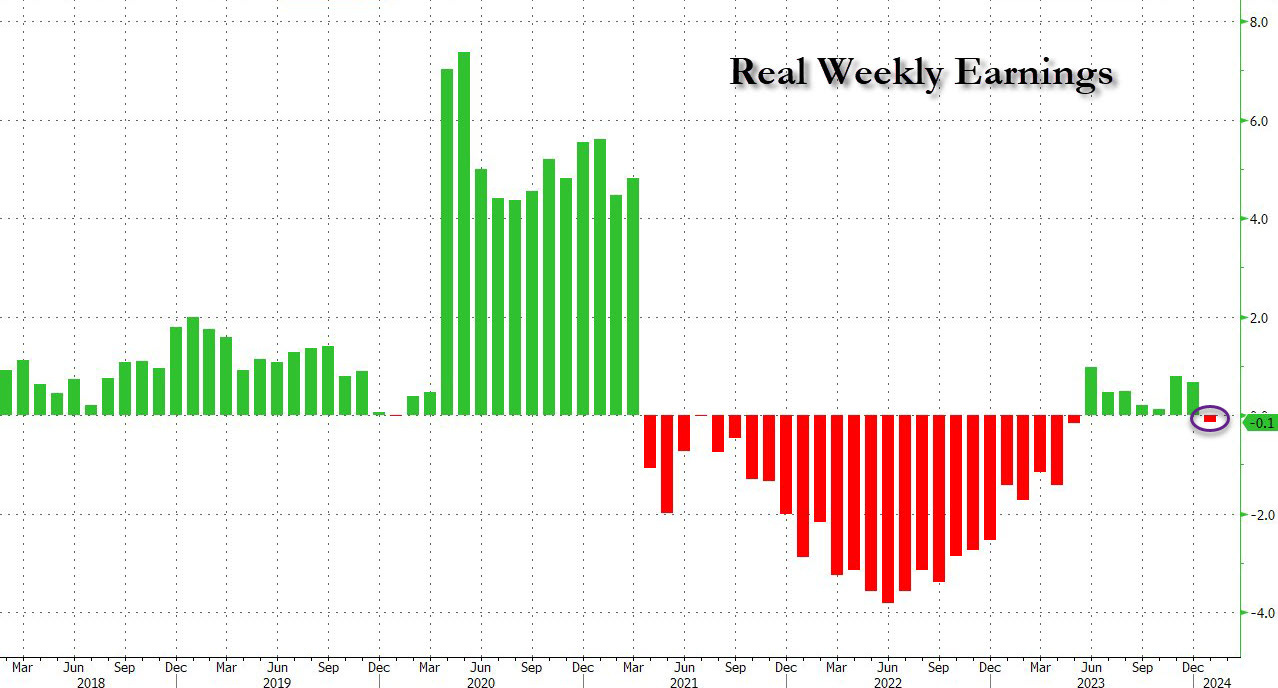

Wages have indeed risen in the U.S. (more than in Europe), but at a much slower pace than inflation. Catching up in the final months of 2023 did not make up for the collapse in real wages during the first inflationary surge. The bad news for Mrs. Yellen is that real wages are starting to fall again...

The Treasury's stance on inflation shows that the choice has long since been made in terms of US fiscal policy. This choice is not conducive to the fight against inflation which, given the latest indicators, the Fed should continue to wage. The choice favors debt dilution through higher inflation. The Treasury suggests that government bonds will gradually be redeemed in monkey money, reflecting the strategy's desire to let inflation run its course.

The Fed does not share this approach at all. The central bank's main mission is to fight inflation, and the latest figures do not allow the Fed to make an immediate shift in its monetary policy.

Will the Treasury have enough influence to force the Fed to act?

Or will monetary policy continue on an independent course, ignoring the Treasury's constraints?

In any case, the poor inflation figures are sowing doubts: the markets have halted their parabolic ascent, rates have started to rise again, and the dollar is again testing its highs against the yen and the euro.

Gold is back below $2,000 levels: when the Chinese market is closed, there is no physical demand to enable arbitrage between London and Shanghai. The market then finds itself entirely in the grip of the algos of the "paper" markets, which sell gold, as rates and the dollar start to rise again.

In last week's article, I wrote: "If history repeats itself, we're likely to see a pullback in gold prices due to cheap selling of futures contracts on the COMEX, precisely during the Shanghai closure."

This week's correction is therefore quite logical insofar as Shanghai was closed. For the first time this year, sales on the COMEX (which systematically take place at the opening of futures markets, i.e. precisely at 8:30 a.m. New York time) were not supported by the Chinese market.... since it was closed!

Since the beginning of the year, paper gold sales have benefited physical metal accumulators. Rising physical demand has had no effect on prices precisely because of these sales on derivative markets, enabling physical gold buyers to accumulate at prices disconnected from real physical demand.

As mentioned last week, 271 tons of gold were delivered to the Chinese market in January.

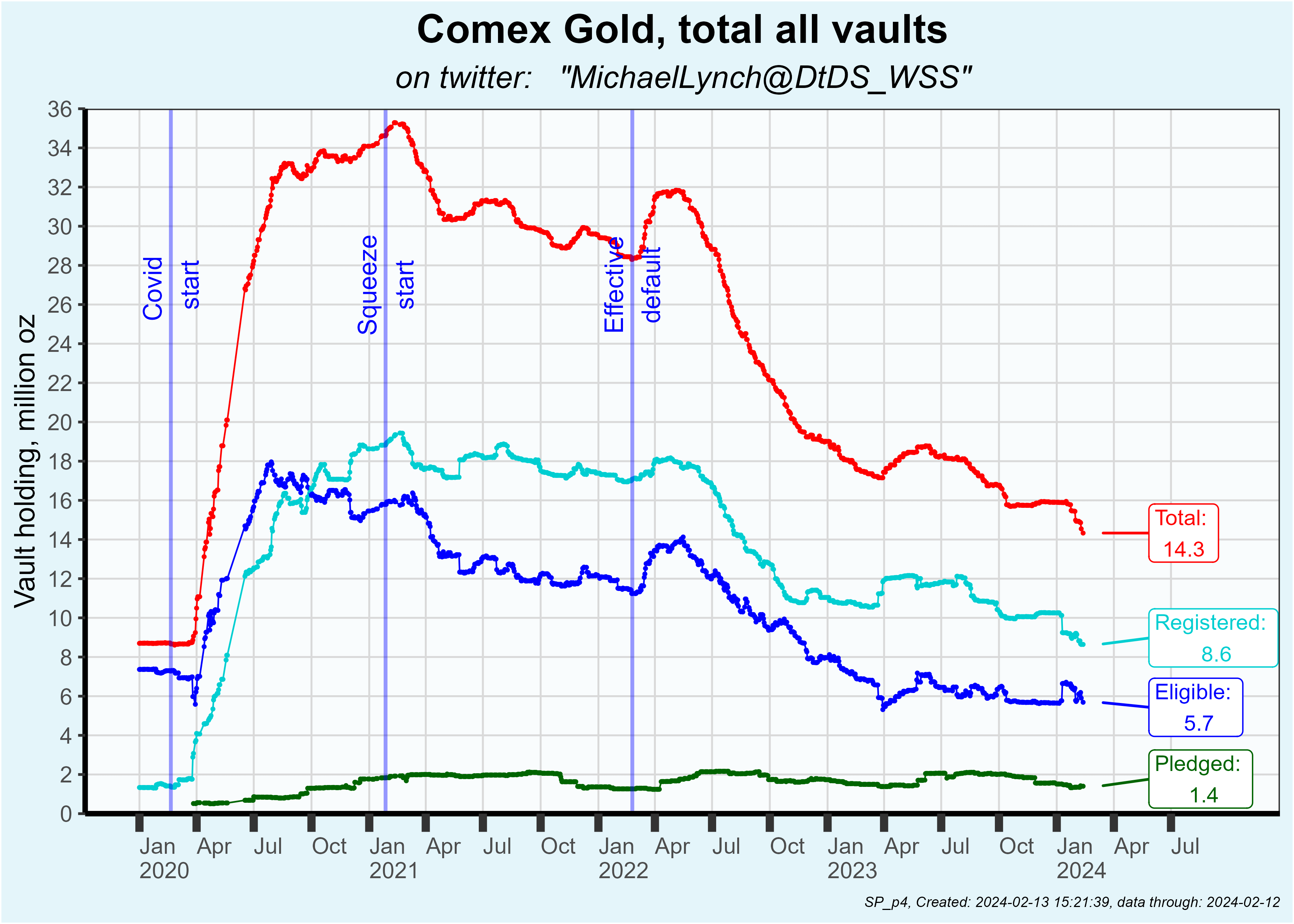

On the COMEX, remarkable delivery volumes were recorded. Tuesday saw a record delivery figure of 6.7 tons. In a single month, 48 tons were delivered on the COMEX, representing 10% of total reserves. The level of stocks available for delivery (registered) returned to its lowest levels ever.

While algorithms are selling paper gold on derivatives markets, the accumulation of physical gold is accelerating in China, and is also expanding in the West thanks to deliveries on the futures market.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.