In my last article referring to the gold rush in China, I pointed out that gold withdrawals from the Shanghai Gold Exchange (SGE) rose again in January 2024 (+271 tons), reaching their second highest level since 2008:

Chinese SGE Gold/Silver Withdrawals for January pic.twitter.com/MDB1mArYk0

— GoldBroker (@Goldbroker_com) February 8, 2024

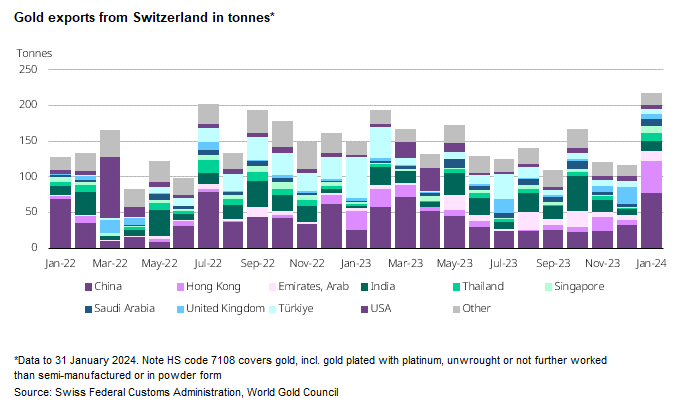

This week's Swiss export figures confirm the impressive wave of physical gold purchases in China:

In January, Swiss gold exports jumped by 86% on the previous month, to 216 tons. This was the highest monthly total since December 2016. Gold exports saw significant monthly increases to Asia and the Middle East, offsetting weak trade to Western markets and Turkey.

Swiss smelters are currently reorienting their market towards Asia and the Middle East as interest in physical gold declines in the West.

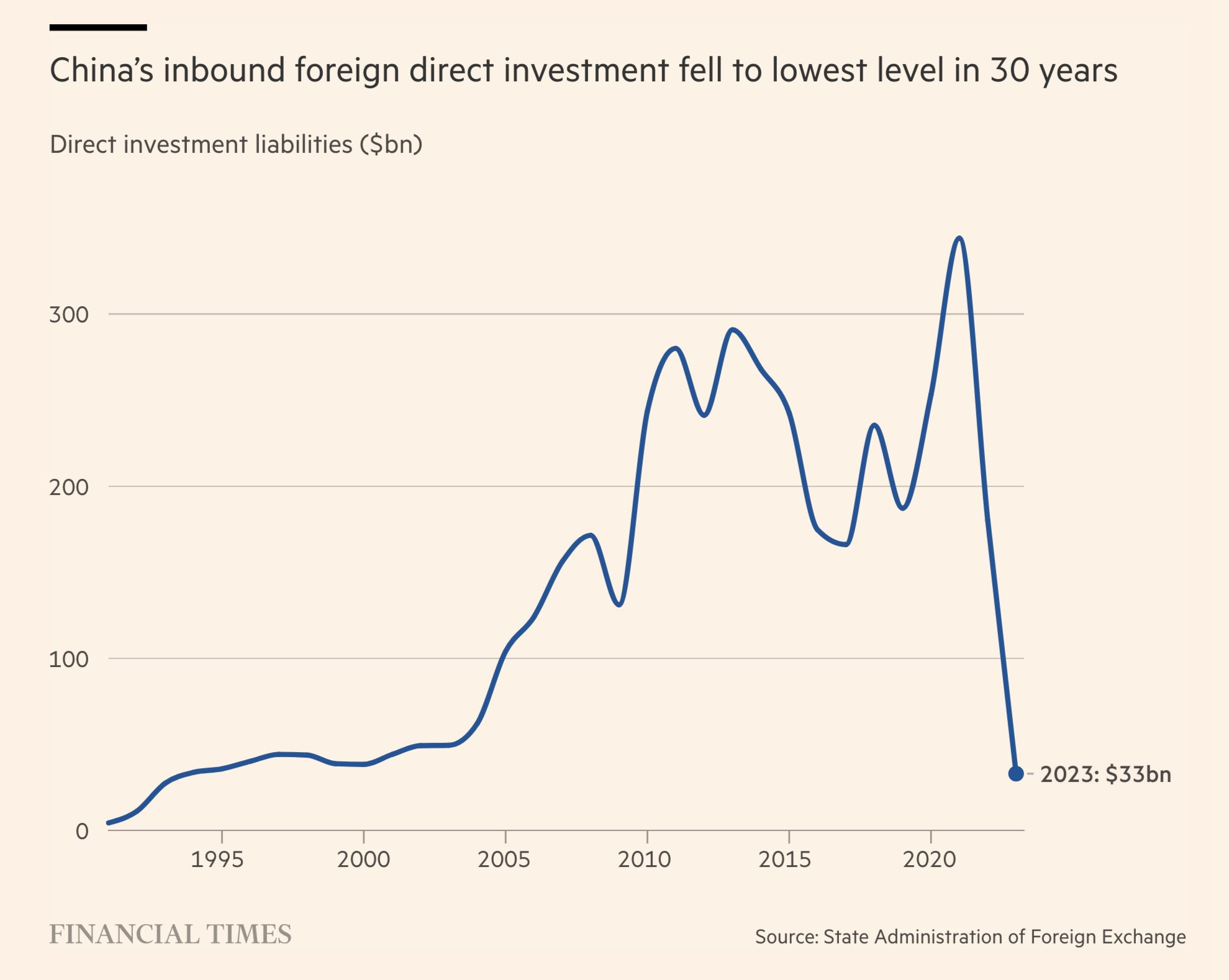

This gold rush comes at a time when Western investors are turning away from the Chinese stock market. Direct investment in Shanghai is back to where it was thirty years ago:

This decline in interest in the stock market has encouraged a gold rush in China. Gold is once again the preferred investment in Asia, to the detriment of the stock market and real estate.

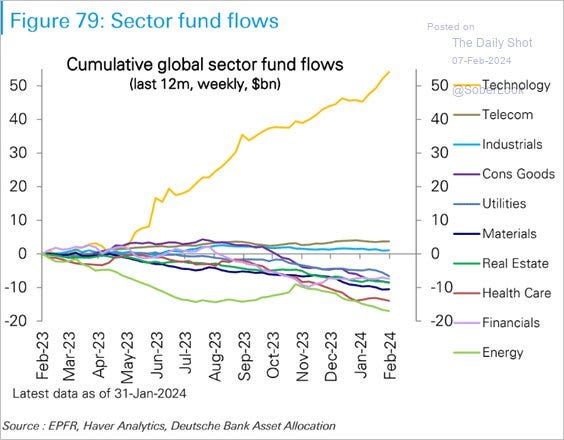

In the West, we're not seeing a gold rush, but rather a rush into technology stocks. Institutional funds are abandoning virtually all other sectors to focus their investments exclusively on the technology sector.

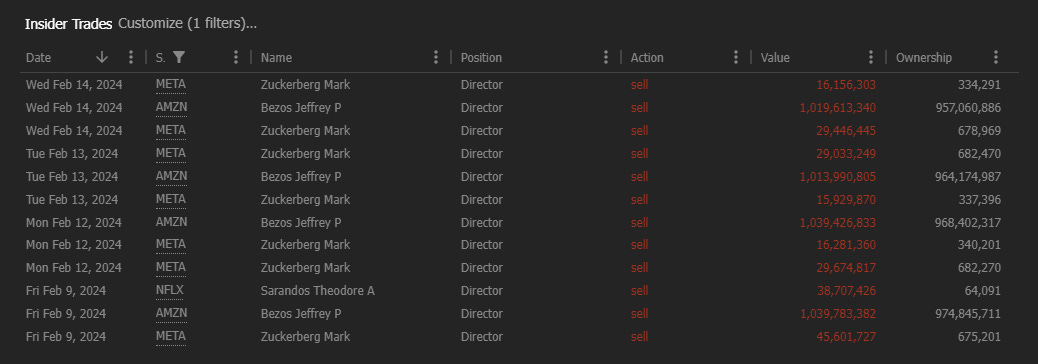

This rush into technology stocks is taking place at a time when insider sales are accelerating: Amazon founder Jeff Bezos is parting with over $4 billion worth of shares, META CEO Mark Zuckerberg is selling close to $1 billion, and Netflix co-CEO Theodore Sarandos is liquidating $38 million worth of shares.

The allocation of global savings has never been as concentrated as it is today. Even on the eve of the Internet stock market crash in 2000, there was less concentration. What's more, there is a higher level of leverage today in a more fragile economy than in 2000.

Market capitalization relative to GDP now stands at 180%, compared with 130% back then.

The preponderance of "passive" funds increases the risk of a deflation potentially more pronounced than that of the last Dot-com bubble.

On the other hand, many people have forgotten that in 2000, the US economy was much more dynamic than it is today. While current growth figures are certainly better than expected, with GDP growth of 3% in the last quarter, in 2000 growth was at 5%. What's more, back then, we weren't in such a high public spending environment as we are today. Economic growth in the US in 2000 was not supported at arm's length by public spending.

Today, despite a very accommodating monetary and fiscal policy, the economy is even showing signs of weakness. The latest retail sales figures underline this slowdown, with a decline of -0.8% in the US (versus +0.6% the previous month), exceeding estimates of -0.2%. Such fragility was not seen in 2000, but it did not prevent a market correction and a collapse in Internet stocks. With the promise of 20% growth for leading stocks failing to materialize, market sentiment abruptly reversed.

Today, we face the same risk. Any growth of less than 20% in stocks linked to the artificial intelligence bubble risks changing market sentiment. Even if this change does not occur this year, the risk of a brutal shift towards growth stocks to defensive stocks is even more pronounced today than it was during the last Dot-com bubble. Not because the artificial intelligence revolution is being called into question, but simply because the anticipation of slightly lower-than-market-expected growth for these stocks could lead to a redistribution of savings flows bottlenecked on these stocks.

With more leverage in the system, more passive funds and an economy that may be less robust than it appears, the risk is even greater than in 2000, of a sudden switch of savings from this growth sector to a more defensive one.

This is exactly what happened in 2000, and initiated gold's great bull phase: in the space of ten years, between 2000 and 2010, the price of gold rose from $255 to $1,700!

Under what conditions could such a shift in savings occur today?

Analyst Alasdair Macleod estimates that of the $150 trillion in global savings, less than 1% is currently invested in gold. This percentage is even lower than in 2000.

Even an adjustment to 2% would require the immediate availability of 23,000 tons of physical gold! This represents 10% of all the gold ever mined in human history. Global production is around 3,000 tons a year, and central banks have recently accumulated just over 1,000 tons in the last two years.

Even a small shift of global savings into physical gold is simply not feasible: the available supply of physical gold is insufficient.

This fact is often overlooked, even by advocates of gold-linked paper assets.

Physical gold reserves are too limited to absorb even a slight shift in Western investors' allocations.

And it is probably this reality that is currently fuelling purchases of physical gold at the expense of paper gold.

Demand for physical gold is more significant than demand for exposure to gold derivatives.

Demand for gold is therefore increasingly concentrated in physical gold, while speculation in gold derivatives is declining.

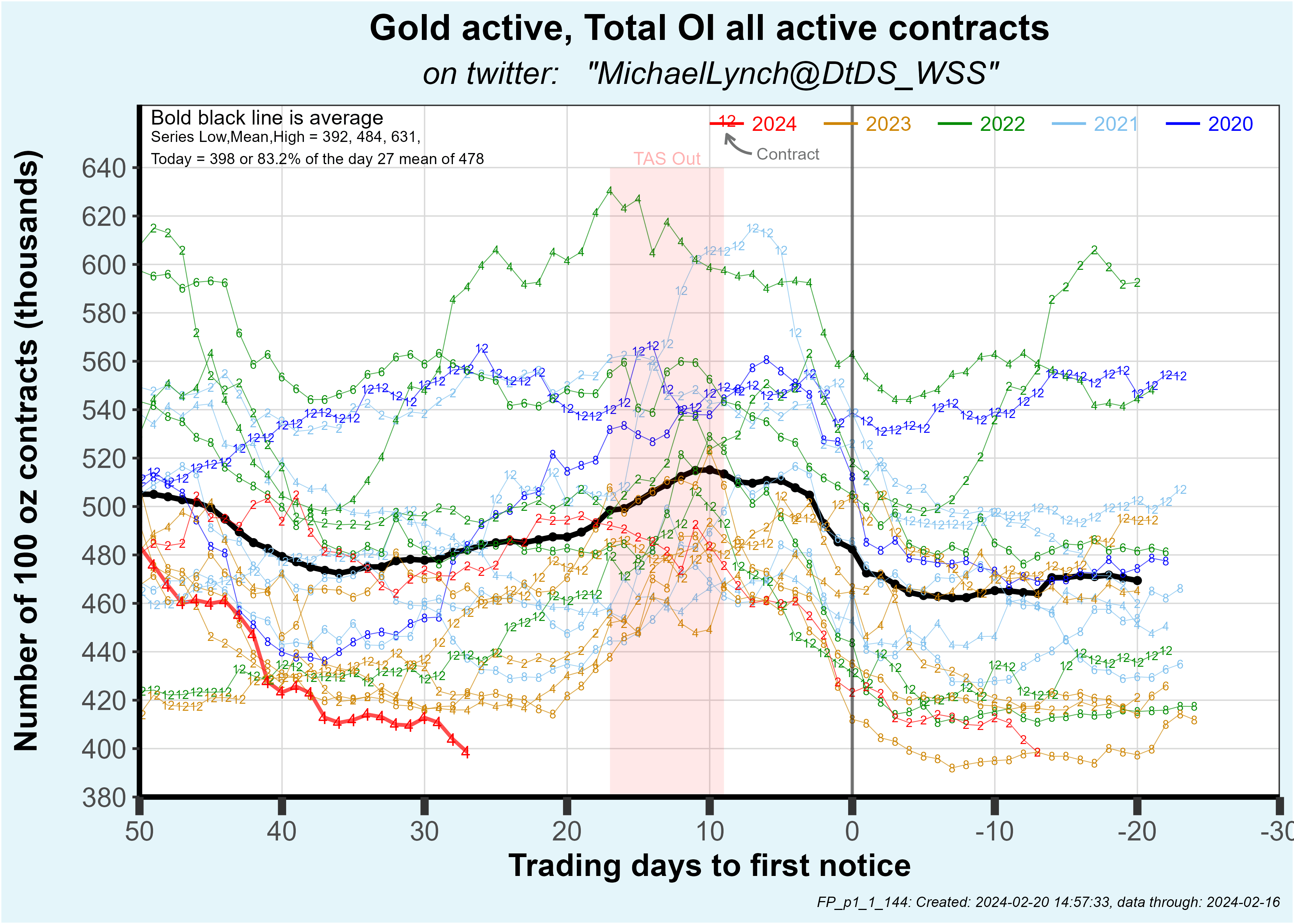

Open interest in gold futures totaled 407,000 contracts, reaching its lowest level in five years:

Paper gold speculation is falling... and requests for immediate delivery on the COMEX have been rising in recent weeks.

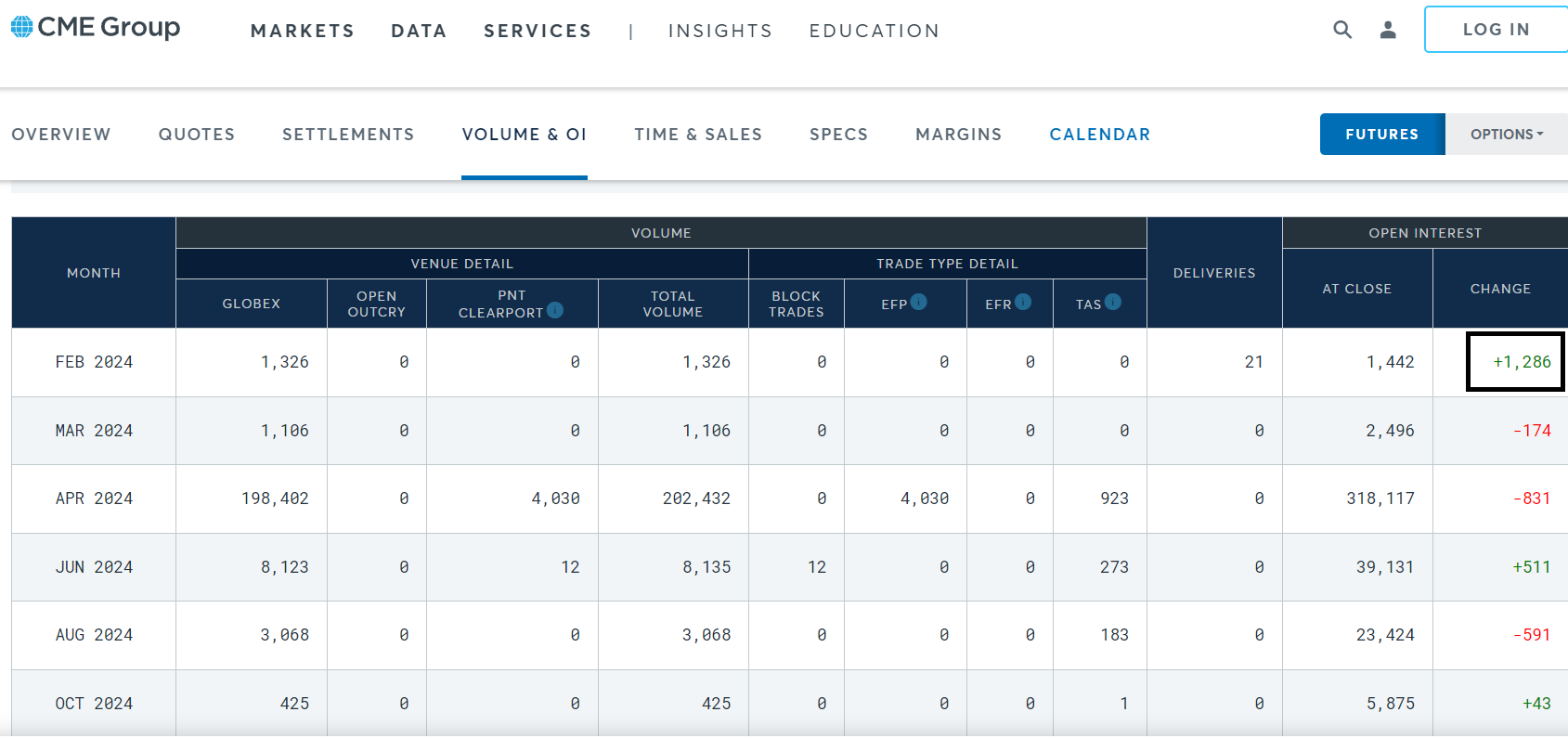

With just a few hours to go before the February contract expires, open interest for the current month has jumped by 1,286 contracts:

These contracts are intended for delivery requests, as they are opened at the last minute. One or more participants use the COMEX to immediately acquire four tons of physical gold (each contract representing 100 troy ounces of gold) on a market not initially intended to be stripped in this way.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.